As I've posted before, I'm very keen on the information that can be gleaned from business and consumer opinion surveys: they start with some simple questions but generate sophisticated information about what's happening in an economy.

In most countries, including here and in Australia, they're generated by the private sector, but some governments have also embraced them, notably France, where the statistics office INSEE has a suite of long-running ones.

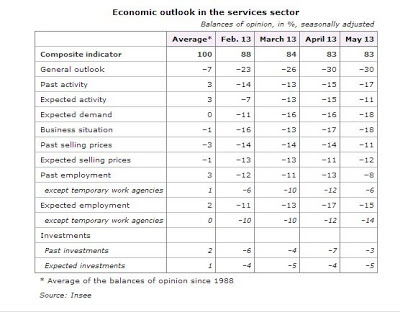

Here are some recent examples. Below is the latest (May) survey of business opinion in the services sector in France (just by way of illustration - you'd get the same sorts of results from INSEE's other sectoral surveys).

This is interesting in itself as a snapshot of the current state of the economy - you can see the weak state of things in France, which will come as no surprise - but it also shows something more permanent. In France, as in other countries, businesspeople tend to be generally more optimistic about their own businesses than they are about the economy as a whole (the 'general outlook' line tends to be well below the two lines about what's happening to the respondents' own and expected activity).

Here are the longer-term numbers.

On average (over the past 25 years) French businesses tend on balance to be mildly negative (-7) on the general outlook and on the 'business situation' (-1) but mildly optimistic about their own past (+3) and expected (+3) activity, as well as on their own employment and investment intentions. You could well read into this that French businesses have little time for the idiots at the wheel in Paris, but are carrying on regardless as best they can.

If you think businesses' scepticism about the French economic environment is high, wait till you see what the person in the street thinks. Here's the data from INSEE's May consumer confidence survey.

On average, over the past 25 years, French households have rated the 'general economic situation' as dire, with a net balance of -43 (equivalent to 28.5% of respondents rating it good, and 71.5% rating it bad). And they're currently reporting it as substantially worse again, with a net balance of -79 (equivalent to 89.5% downbeat, and 10.5% upbeat). Interestingly, you can see one of their responses - they're planning to save more than usual (+30 now compared to the long-term average of +18), partly because they are overwhelmingly convinced (+81) that unemployment is going to get even worse than its current 10.6%.

If you haven't fossicked around in these opinion surveys, give them more of a go. They're invaluable for getting a sharp insight into the state of economic activity.

No comments:

Post a Comment

Hi - sorry about the Captcha step for real people like yourself commenting, it's to baffle the bots