Treasury's latest Monthly Economic Indicators came out today, with media coverage noting in particular how we are, temporarily, growing faster than Australia.

Or as Treasury put it, "The rebound in the terms of trade [in the first six months of this year] has also driven an acceleration in growth of real gross national disposable income (RGNDI) – a purchasing power-adjusted measure of national income – with RGNDI up by 1.6% in the quarter. In a reflection of the recent divergence in the performance and outlook for the New Zealand and Australian economies, annual RGNDI growth in the June quarter accelerated ahead of that in Australia".

Doesn't often happen, and it's partly down to the capricious commodity gods favouring our product mix over the Aussies', not to mention that we'd rather not have had the Canterbury earthquake in the first place even if it's now boosting construction activity, but we might as well enjoy our little moment of faster-than-them.

If you're not aware, the Monthly Indicators comes with a handy chart pack which covers pretty much all the indicators you'd be looking for, and if, like me, you prefer graphs to spreadsheet data, it's a very useful resource.

Here's one graph that caught my eye.

It goes to the much debated issue of how much of our current house price inflation may be reflecting the physical supply/demand dynamics of the house market and how much may be reflecting monetary policy or bank lending standards being "too loose". It's not either/or, and both could well be in play, and the two are linked in any event, but if it's predominantly one (genuine "I need to buy a house to live in" demand bumping up against tight "there's nothing in the real estate agents' windows" supply) rather than the other ("I've got to get into this hot market market at these cheap mortgage rates"), it leads you down very different policy paths.

This graph shows the reasonably close link between net migration and changes in house prices, and would tend to support the mostly supply/demand explanation of house prices.

It also suggests strong house price inflation down the track. That blue line is the past twelve months' net migration (an extra +13,160 people). But that period includes the last five months of 2012, when there was little net migration happening. In the past three months, net migration has been running at an annual rate of +25,000 people. Project that blue line up to around 25,000 - and you're looking down the barrel of even faster house price rises.

Monday, 30 September 2013

Sunday, 29 September 2013

Some interesting third party perspectives on UFB

As I've been fossicking around in the general area of the government's telecom policy review, UFB pricing, the debate on the 'copper tax', and the Commerce Commission's pricing of access to the copper network, I've come across some interesting sites and perspectives which I thought I'd share, especially as they don't originate from the usual suspects (incumbent telcos, access-seeking telcos, and their economic consultancies).

One is the digitl blog, run by Bill Bennett, a freelance IT and business journalist. He describes it as "my new journalism project. It reports on digital innovation, how it empowers and inspires New Zealanders. I'll deliver news, features, analysis and informed commentary. Digitl will cover enterprise computing, personal productivity, telecommunications and everything in between", and it certainly does. The latest three posts (for example) are on a new ConferenceCam from Logitech, Westpac's latest online banking offering, and Telecom turning the old phone boxes into Wi-Fi hotspots.

Recent interesting posts on the whole UFB/copper thing have included Are Chorus and UFB now a political football?, and Why Telecom NZ doesn’t oppose government copper intervention. Also on his site was this: French expert says NZ Government drove too hard a bargain on UFB.

Which I looked up at its source, Benoît Felten's blog, Fiberevolution, where, he says, he "complements his day job [analysis of strategies related to technologies like fibre] by blogging about the economic and social impacts of next generation access". The original post was A Way Out of the New Zealand Copper Price Quagmire?. His proposed 'way out', by the way, is "introducing a copper switchoff mechanism in fibered areas", which he argues "wouldn’t solve all of Chorus’ issues, but it would create a radical long-term improvement of cost-structure as the company would no longer have to manage two networks in parallel (and the copper network is the costlier one to maintain in the first place). Chorus would still have a big cash-flow issue to get to that point and keep investing in Fiber, but I suspect that would be manageable, either through government or government-backed loans".

Felten as part of his post came up with this graph, which he uses "in NBN related conferences [the NBN is Australia's version of our UFB] to show the amount [cost] per household and the scope of intervention in parallel" (Bill Bennett was also taken by it, on his blog). It shows the cost per household of laying fibre, charted against the percentage of households targetted.

The point Felten wanted to make was that "it should be stressed, again and again, that the government got an amazingly good deal out of Chorus and other LFCs [Local Fibre Companies], probably too good", and you can read where he goes with this logic in the rest of his post.

I took something else from it as well. You'll recall that one of the moving parts in this whole UFB/copper pricing debate is the benchmarking that the Commerce Commission does - setting an initial price for access to bits of the New Zealand copper network, based on what similar access costs in places "like us" overseas. If you're not especially au fait with benchmarking, here are some previous posts on the the logic of the idea and a practical application of the process.

There are folks who don't think benchmarking is a great idea, and that the Commission shouldn't be doing it (not that they currently have any choice in the matter, as it's set down in the Telecommunications Act as what they must do). And there are also people who feel that the latest example of the Commission's benchmarking is a dead end, since it only came up with two countries overseas to compare us with (Denmark and Sweden), and that's not enough to be a good sample.

While I have some sympathy with that second point, I have none at all with the first one. I sat through several of these exercises as a Commissioner, and came away quite convinced that overseas costs were quite a serviceable signal of what local equivalent costs might be (and, I have to add, typically well below the prices actually being charged locally).

I also sat through many days of hearings where assorted folks had a go at making the case that New Zealand had its local little peculiarities that made costs here higher than overseas - the country is long and stringy, arguably relatively difficult to tunnel through, and with an odd population distribution with one dense conurbation and a thinly sprinkled population everywhere else. While I listened to a lot of evidence on this, and with an open mind, none of it seemed terribly convincing at the end of the day. If you looked, for example, at other long and stringy places (Norway is one), you didn't tend to find that costs were unusually high there.

And that, to me, is another lesson from Felten's graph. Does New Zealand look like an unusually expensive place to lay fibre? No. Quite the reverse: you seem to get rather more bang per fibre-laying buck than you do elsewhere. Australia excepted: it looks like an outlier, and you can see why the new government in Australia has been hacking back at the scale of their NBN. There's a lot of other, political stuff going on too, but you can understand why the cost is in play.

In other words, Felten has done a bit of independent, third party benchmarking for us, and for me it shows, yet again, that there's nothing to support the idea that telco costs are unusually high in New Zealand, and justify unusually high prices.

And finally, another blog has got interested in the UFB/copper issues. It doesn't need any introduction from me - David Farrar's long standing, highly energetic Kiwiblog must be one of the most widely read in the country - but in case you've missed it, he's weighed in on the side of lower copper access prices, and you'll be interested in Why the price of copper broadband should be lower and More thoughts on copper pricing.

One is the digitl blog, run by Bill Bennett, a freelance IT and business journalist. He describes it as "my new journalism project. It reports on digital innovation, how it empowers and inspires New Zealanders. I'll deliver news, features, analysis and informed commentary. Digitl will cover enterprise computing, personal productivity, telecommunications and everything in between", and it certainly does. The latest three posts (for example) are on a new ConferenceCam from Logitech, Westpac's latest online banking offering, and Telecom turning the old phone boxes into Wi-Fi hotspots.

Recent interesting posts on the whole UFB/copper thing have included Are Chorus and UFB now a political football?, and Why Telecom NZ doesn’t oppose government copper intervention. Also on his site was this: French expert says NZ Government drove too hard a bargain on UFB.

Which I looked up at its source, Benoît Felten's blog, Fiberevolution, where, he says, he "complements his day job [analysis of strategies related to technologies like fibre] by blogging about the economic and social impacts of next generation access". The original post was A Way Out of the New Zealand Copper Price Quagmire?. His proposed 'way out', by the way, is "introducing a copper switchoff mechanism in fibered areas", which he argues "wouldn’t solve all of Chorus’ issues, but it would create a radical long-term improvement of cost-structure as the company would no longer have to manage two networks in parallel (and the copper network is the costlier one to maintain in the first place). Chorus would still have a big cash-flow issue to get to that point and keep investing in Fiber, but I suspect that would be manageable, either through government or government-backed loans".

Felten as part of his post came up with this graph, which he uses "in NBN related conferences [the NBN is Australia's version of our UFB] to show the amount [cost] per household and the scope of intervention in parallel" (Bill Bennett was also taken by it, on his blog). It shows the cost per household of laying fibre, charted against the percentage of households targetted.

The point Felten wanted to make was that "it should be stressed, again and again, that the government got an amazingly good deal out of Chorus and other LFCs [Local Fibre Companies], probably too good", and you can read where he goes with this logic in the rest of his post.

I took something else from it as well. You'll recall that one of the moving parts in this whole UFB/copper pricing debate is the benchmarking that the Commerce Commission does - setting an initial price for access to bits of the New Zealand copper network, based on what similar access costs in places "like us" overseas. If you're not especially au fait with benchmarking, here are some previous posts on the the logic of the idea and a practical application of the process.

There are folks who don't think benchmarking is a great idea, and that the Commission shouldn't be doing it (not that they currently have any choice in the matter, as it's set down in the Telecommunications Act as what they must do). And there are also people who feel that the latest example of the Commission's benchmarking is a dead end, since it only came up with two countries overseas to compare us with (Denmark and Sweden), and that's not enough to be a good sample.

While I have some sympathy with that second point, I have none at all with the first one. I sat through several of these exercises as a Commissioner, and came away quite convinced that overseas costs were quite a serviceable signal of what local equivalent costs might be (and, I have to add, typically well below the prices actually being charged locally).

I also sat through many days of hearings where assorted folks had a go at making the case that New Zealand had its local little peculiarities that made costs here higher than overseas - the country is long and stringy, arguably relatively difficult to tunnel through, and with an odd population distribution with one dense conurbation and a thinly sprinkled population everywhere else. While I listened to a lot of evidence on this, and with an open mind, none of it seemed terribly convincing at the end of the day. If you looked, for example, at other long and stringy places (Norway is one), you didn't tend to find that costs were unusually high there.

And that, to me, is another lesson from Felten's graph. Does New Zealand look like an unusually expensive place to lay fibre? No. Quite the reverse: you seem to get rather more bang per fibre-laying buck than you do elsewhere. Australia excepted: it looks like an outlier, and you can see why the new government in Australia has been hacking back at the scale of their NBN. There's a lot of other, political stuff going on too, but you can understand why the cost is in play.

In other words, Felten has done a bit of independent, third party benchmarking for us, and for me it shows, yet again, that there's nothing to support the idea that telco costs are unusually high in New Zealand, and justify unusually high prices.

And finally, another blog has got interested in the UFB/copper issues. It doesn't need any introduction from me - David Farrar's long standing, highly energetic Kiwiblog must be one of the most widely read in the country - but in case you've missed it, he's weighed in on the side of lower copper access prices, and you'll be interested in Why the price of copper broadband should be lower and More thoughts on copper pricing.

Thursday, 26 September 2013

Competition to the rescue - again

The Reserve Bank issued its latest quarterly Bulletin today, and it included a chapter on why inflation has turned out lower - much lower - than the Bank (and others) had expected. Here's the guts of it, in one graph.

In this graph, the Bank's decomposed why its June '12 forecast for inflation in June '13 (2.1%) turned out to be so much higher than the actual outcome (0.7%). The biggest single contributor was the unexpectedly high level of the Kiwi dollar, but there were actually contributions from all over the place, with both tradables and non-tradables prices lower than expected.

It's nice to see that greater competition placed its part in this. The Bank mentioned in particular the impact of lower communication prices (something I've posted about before) from a mixture of increased competition (the likes of 2degrees arriving) and price-reducing regulation (of costs such as mobile termination). Here's the impact - a cumulative drop of more than 15% in price over the three years to June '13.

In this graph, the Bank's decomposed why its June '12 forecast for inflation in June '13 (2.1%) turned out to be so much higher than the actual outcome (0.7%). The biggest single contributor was the unexpectedly high level of the Kiwi dollar, but there were actually contributions from all over the place, with both tradables and non-tradables prices lower than expected.

It's nice to see that greater competition placed its part in this. The Bank mentioned in particular the impact of lower communication prices (something I've posted about before) from a mixture of increased competition (the likes of 2degrees arriving) and price-reducing regulation (of costs such as mobile termination). Here's the impact - a cumulative drop of more than 15% in price over the three years to June '13.

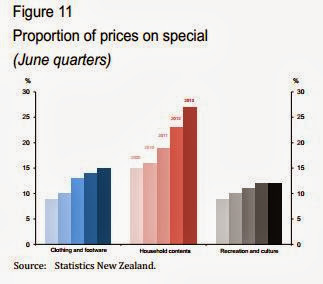

But competition has also been hotting up in the rest of the economy, as this very interesting graph shows.

To measure the increased degree of competition, the Bank has cleverly dug out the percentage of goods on 'special' (a statistic that Statistics NZ collects as part of its data gathering for compiling the CPI). And it's found that the percentage of goods on special has been rising steadily in a number of sectors. The Bank commented that "The unusual combination of relatively subdued domestic demand and a persistently high exchange rate has resulted in strong price competition, with greater-than-usual levels of price discounting (figure 11) [i.e. the graph you see above] and many retailers reporting pressure on profit margins. Persistent strength in the exchange rate results in imported input costs staying low for a prolonged period. As a result, retailers are likely to be more confident about passing reductions in wholesale costs though to selling prices".

To be honest, I wasn't aware that Stats published this data, and in fact, I gather from the ever helpful Chris Pike, Manager Prices at Stats, that it's not a regular part of the CPI release, but has been made available at recent press conferences when the CPI has been released.

Chris sent me through the data on price discounting since December '08, and very interesting reading it made, too. Currently 14% of everything in the shops is being called a 'special', with the percentages varying markedly from sector to sector. The big discounters are major household appliances (38% of prices on special); furniture and furnishings, and electrical appliances for personal care (both 35%); small household electrical appliances (32%); glassware, tableware and household utensils (28%); household textiles and audio-visual equipment (both 26%).

What's going on here is partly a marketing ploy, of course: what's being called a 'special' is in fact no more than an attractive way of packaging lower import costs. But irrespective of what it's called, the good news is that more and more retailers are having to pass through those lower import costs to us consumers. It may not last, if that "relatively subdued domestic demand" picks up and retailers figure they don't have to scrap as hard as they do now, but enjoy it while it's all on. And tuck away the longer-term lesson from this, which is that competitive markets are your first-best protection against rorts and profiteering.

Speaking of which, I couldn't help noticing the sectors where discounting isn't taking place, even though you would guess that the exchange rate has been benefiting those import-heavy sectors as much as it has been benefiting the likes of TVs.

It didn't surprise me in the least that pharmaceuticals had only 6% discounted, nor that "other medical products" only had 1% discounted. Bastions of competition, these are not. More surprising were new cars (6%) and new motorbikes (3%). Maybe lower import costs are being passed on to consumers in some other way, maybe as lower base sticker prices, rather than as 'specials' off hypothetical list prices.

I certainly hope so, because on the face of it those numbers look well off the pace. If the Commerce Commission ever gets the powers to proactively investigate the state of competition in particular markets (something I have been lobbying the Productivity Commission to recommend), it could do worse as a starting point to look at those markets where retailers don't seem to be as sharp-pencilled as the others.

Wednesday, 25 September 2013

How governments rort their own countries' airline passengers

A while ago I had a go at the protectionist stupidity of typical bilateral inter-government airline agreements, as instanced on this occasion by Cathay Pacific having to get the Australian government's permission to increase the number of flights it would like to make between Hong Kong and Australia.

More recently I've come across some research documenting just how much of a dead hand these agreements tend to be, and how much more airline traffic would be enabled by having more liberal arrangements.

The research is "The Sky Is Not Flat: How Discriminatory Is the Access to International Air Services?", by Roberta Piermartini and Linda Rousová (American Economic Journal: Economic Policy 2013, 5(3): 287–319, http://dx.doi.org/10.1257/pol.5.3.287).

First of all, some facts. The authors have gone through a huge database of 2,300 air services agreements. These agreements tend to be quite illiberal in their provisions.

On pricing, for example, the authors say (p291) that "The most restrictive regime is that of dual approval, whereby both parties have to approve the tariff before this can be applied. The most liberal regime is free pricing, when prices are not subject to the approval by any party". Of the 2,300 agreements, fully 1,625 require dual approval, and only 381 allowed for free pricing.

On capacity ("the volume of traffic, frequency of service, and aircraft types"), again the authors note that there is a menu of potential options - "Ranging from the most restrictive to the most liberal regime, three commonly used capacity clauses are: predetermination, Bermuda I [don't ask], and free determination" - and again the data show the more illiberal terms being adopted. Predetermination and "other restrictive" provisions were adopted 1,446 times, while free determination and "other liberal" were adopted 327 times.

The authors come up with an index that measures the overall degree of liberalisation of airline services agreements, and on that basis they find (p294) that "Overall, existing agreements provide a limited degree of liberalization of the aviation market. Approximately 75 percent of agreements are very restrictive...Very few agreements introduce an intermediate degree of liberalization. A high degree of liberalization ...is reached...only in 15 percent of country-pairs. This is mainly because of the liberalization of air services among countries within the EU".

It's not always you find the folks in Brussels on the right end of the deregulation spectrum, so chapeau! to the Eurocrats on this occasion. And boos and hisses to governments elsewhere, who to a greater or lesser degree have been colluding to prevent their own consumers (households and businesses) from getting the quantity and pricing of airline services that they should be enjoying.

Because that's what the second leg of the paper establishes: less liberal agreements prevent traffic, more liberal agreements enable it.

"Following the traditional approach of measuring the degree of liberalization by means of an index", they say (p310), "we find strong evidence of a positive and significant impact of the degree of liberalization of the international aviation market on passenger traffic. In particular, we estimate that increasing the degree of liberalization from the twenty-fifth to the seventy-fifth percentile increases passenger traffic by approximately 18 percent. This effect is shown to be robust" (to various potential statistical problems).

And that's what you get, folks, when your enlightened elected representatives put producer interests and "national champion" policies ahead of the consumer's interest.

Oh, and apart from their grotesquerie from an allocative efficiency point of view, did I mention these policies are inequitable as well? Because guess which countries' airlines tend to get least access to world aviation markets? Let's see now - would it be the low and middle income countries? Why, yes it would.

More recently I've come across some research documenting just how much of a dead hand these agreements tend to be, and how much more airline traffic would be enabled by having more liberal arrangements.

The research is "The Sky Is Not Flat: How Discriminatory Is the Access to International Air Services?", by Roberta Piermartini and Linda Rousová (American Economic Journal: Economic Policy 2013, 5(3): 287–319, http://dx.doi.org/10.1257/pol.5.3.287).

First of all, some facts. The authors have gone through a huge database of 2,300 air services agreements. These agreements tend to be quite illiberal in their provisions.

On pricing, for example, the authors say (p291) that "The most restrictive regime is that of dual approval, whereby both parties have to approve the tariff before this can be applied. The most liberal regime is free pricing, when prices are not subject to the approval by any party". Of the 2,300 agreements, fully 1,625 require dual approval, and only 381 allowed for free pricing.

On capacity ("the volume of traffic, frequency of service, and aircraft types"), again the authors note that there is a menu of potential options - "Ranging from the most restrictive to the most liberal regime, three commonly used capacity clauses are: predetermination, Bermuda I [don't ask], and free determination" - and again the data show the more illiberal terms being adopted. Predetermination and "other restrictive" provisions were adopted 1,446 times, while free determination and "other liberal" were adopted 327 times.

The authors come up with an index that measures the overall degree of liberalisation of airline services agreements, and on that basis they find (p294) that "Overall, existing agreements provide a limited degree of liberalization of the aviation market. Approximately 75 percent of agreements are very restrictive...Very few agreements introduce an intermediate degree of liberalization. A high degree of liberalization ...is reached...only in 15 percent of country-pairs. This is mainly because of the liberalization of air services among countries within the EU".

It's not always you find the folks in Brussels on the right end of the deregulation spectrum, so chapeau! to the Eurocrats on this occasion. And boos and hisses to governments elsewhere, who to a greater or lesser degree have been colluding to prevent their own consumers (households and businesses) from getting the quantity and pricing of airline services that they should be enjoying.

Because that's what the second leg of the paper establishes: less liberal agreements prevent traffic, more liberal agreements enable it.

"Following the traditional approach of measuring the degree of liberalization by means of an index", they say (p310), "we find strong evidence of a positive and significant impact of the degree of liberalization of the international aviation market on passenger traffic. In particular, we estimate that increasing the degree of liberalization from the twenty-fifth to the seventy-fifth percentile increases passenger traffic by approximately 18 percent. This effect is shown to be robust" (to various potential statistical problems).

And that's what you get, folks, when your enlightened elected representatives put producer interests and "national champion" policies ahead of the consumer's interest.

Oh, and apart from their grotesquerie from an allocative efficiency point of view, did I mention these policies are inequitable as well? Because guess which countries' airlines tend to get least access to world aviation markets? Let's see now - would it be the low and middle income countries? Why, yes it would.

Tuesday, 24 September 2013

A subsidy worth paying?

Last week Amy Adams, the Minister for Communications and Information Technology, announced that $15 million was still up for grabs for anyone willing to build another high-capacity submarine fibre cable connecting New Zealand to Australia and the US (as the current monopolist incumbent, Southern Cross Cable, does).

I'm fully on board with her comment that "Building a new cable will further increase the resilience of New Zealand’s international telecommunications links and also introduce more competition on the route, as well as providing additional capacity". And maybe us consumers oughtn't look gift horses in the mouth. And governments are in the business of promoting good stuff and dissuading bad stuff all the time, and this is no different.

And yet: I'm a bit in two minds about the desirability of subsidising new entry like this. I suppose where I've got to is that I'd like to understand a bit more of the policy reasoning behind this subsidy.

Perhaps the rationale is the straightforward and uncontroversial one: there are national positive externalities from a new private sector cable project, that justify a taxpayer subsidy to see them realised. And maybe there are: that resilience point, for example, could be one of them. Or maybe we'll get faster UFB uptake (in which case, it has been argued, there could be large national positive spin-offs), if the cost of fibre connection with the rest of the world gets cheaper. Or perhaps it's a low cost way of helping to deal to whatever market power Southern Cross possesses.

The incumbent's view is that "Southern Cross' prices are effectively set by those that prevail on the internationally more competitive US-Australia route". That may be true if you're looking for a quote for US-Australia capacity from Southern Cross, but unless I'm missing something I can't see it competing away their hammerlock on the US-NZ or Australia-NZ legs. Southern Cross also said that "its prices had reduced by an average of 22 per cent year-on-year" over 2000-12. I'll accept that's true, and also that it means very large cumulative reductions: a $1 million dollar invoice in 2000 would have turned into $92,000 in 2012. But it doesn't mean that the price is yet anywhere near a workably competitive cost-based level.

If this is a market where timely entry is possible, though, and private companies, attracted by what we have to presume are attractive returns earned by Southern Cross, stand ready to build more cable networks, there's much less of a case for a subsidy. And it seems that there are: Hawaiki Cable seems to be getting traction, even if the earlier Pacific Fibre proposal fell over.

If that's so, then Southern Cross are entitled to their (temporary) high profits as the reward for being the first company to roll out a valued piece of infrastructure: they took the risk, they spent the money, and they're entitled to full whack on it until competition takes it away from them. If that's the case, then I'm not sure they deserve to have their competition subsidised into the game against them.

I'm fully on board with her comment that "Building a new cable will further increase the resilience of New Zealand’s international telecommunications links and also introduce more competition on the route, as well as providing additional capacity". And maybe us consumers oughtn't look gift horses in the mouth. And governments are in the business of promoting good stuff and dissuading bad stuff all the time, and this is no different.

And yet: I'm a bit in two minds about the desirability of subsidising new entry like this. I suppose where I've got to is that I'd like to understand a bit more of the policy reasoning behind this subsidy.

Perhaps the rationale is the straightforward and uncontroversial one: there are national positive externalities from a new private sector cable project, that justify a taxpayer subsidy to see them realised. And maybe there are: that resilience point, for example, could be one of them. Or maybe we'll get faster UFB uptake (in which case, it has been argued, there could be large national positive spin-offs), if the cost of fibre connection with the rest of the world gets cheaper. Or perhaps it's a low cost way of helping to deal to whatever market power Southern Cross possesses.

The incumbent's view is that "Southern Cross' prices are effectively set by those that prevail on the internationally more competitive US-Australia route". That may be true if you're looking for a quote for US-Australia capacity from Southern Cross, but unless I'm missing something I can't see it competing away their hammerlock on the US-NZ or Australia-NZ legs. Southern Cross also said that "its prices had reduced by an average of 22 per cent year-on-year" over 2000-12. I'll accept that's true, and also that it means very large cumulative reductions: a $1 million dollar invoice in 2000 would have turned into $92,000 in 2012. But it doesn't mean that the price is yet anywhere near a workably competitive cost-based level.

If this is a market where timely entry is possible, though, and private companies, attracted by what we have to presume are attractive returns earned by Southern Cross, stand ready to build more cable networks, there's much less of a case for a subsidy. And it seems that there are: Hawaiki Cable seems to be getting traction, even if the earlier Pacific Fibre proposal fell over.

If that's so, then Southern Cross are entitled to their (temporary) high profits as the reward for being the first company to roll out a valued piece of infrastructure: they took the risk, they spent the money, and they're entitled to full whack on it until competition takes it away from them. If that's the case, then I'm not sure they deserve to have their competition subsidised into the game against them.

Monday, 23 September 2013

Make some time for this essay

If you're like me, the disks arrive with the latest issues of the American Economic Review, the Journal of Economic Literature, the Journal of Economic Perspectives, and you say to yourself, I really must sit down some evening and work my way through them. But things interrupt, time goes by, and life is what happens to us while we are making other plans.

But if you are minded to catch up with at least one of the recent articles, make it this one - Timothy Besley's essay, "What’s the Good of the Market? An Essay on Michael Sandel’s What Money Can’t Buy", in this June's issue of the Journal of Economic Literature (Journal of Economic Literature 2013, 51(2), 478–495, http://dx.doi.org/10.1257/jel.51.2.478). And you'll also need to pop out to the library or a bookstore for Sandel's book, if you haven't read it already.

But if you are minded to catch up with at least one of the recent articles, make it this one - Timothy Besley's essay, "What’s the Good of the Market? An Essay on Michael Sandel’s What Money Can’t Buy", in this June's issue of the Journal of Economic Literature (Journal of Economic Literature 2013, 51(2), 478–495, http://dx.doi.org/10.1257/jel.51.2.478). And you'll also need to pop out to the library or a bookstore for Sandel's book, if you haven't read it already.

You may well have - it created quite a stir when it came out, and it deservedly got a good reception pretty much everywhere, including from Besley in this essay ("a great book and I recommend every economist to read it even though we are not really his target audience. The book is pitched at a much wider audience of concerned citizens"). And it was of course welcomed especially warmly in the sorts of places where markets tend to be scorned in the first place. John Lanchester for example praised it in the Guardian (saying that some might even have wanted a "more sweeping, angrier book, one that is more heated about the morally debased landscape brought to us by the ubiquity of market thinking"), as did John Gray in the New Statesman ("In a culture mesmerised by the market, Sandel’s is the indispensable voice of reason").

Sandel is an internationally respected political philosopher and a professor at Harvard. His book carries the sub-title, "The Moral Limits of Markets", which is his message in a nutshell. As Besley summarises it in the JEL essay (p483), Sandel makes two main points. "First, there is an objection to market outcomes based on fairness. This is partly the standard observation that inequality in market choice is a reflection of underlying inequalities in purchasing power". And "Second, there is the corruption / degradation objection to the use of markets. This is the view that trading in markets can lead to valuable attitudes and norms being damaged or dissolved. So WMCB argues that “markets are not mere mechanisms; they embody certain values. And sometimes, market values crowd out nonmarket norms worth caring about”".

It's that second point that seems to have got most coverage, and it's an interesting one. It's the point that caught my attention, too. I have to confess that I'm a bit of a book-reading tragic, and keep a spreadsheet of books I've read and my comments on them: Sandel, I thought, made a good case that "commercialising some things changes their character for the worse, something you should think about before setting out to create markets in them or create incentives for their use". I didn't necessarily agree that there are many real-life examples that fitted the bill, but I can see the point.

Besley's essay is a terrific resource from many perspectives - it is an excellent survey of where economics has got to with its thinking about markets, as well as a thought-provoking engagement with Sandel's arguments - and I'll leave it to you to work your way through it without much further editorialising.

I will add a few observations, though.

I agree with one of Besley's conclusions, namely that Sandel does not appear to have a good answer to the question, (as Besley puts it, p489), "What are the alternatives to using the market?...If there are problems with using markets to allocate goods, then ultimately we have to say what we should do about it". And I'd just point to the quotes from Yarrow and Wheelan that I've got in the 'Welcome to my blog' sidebar.

And I was also rather baffled by the mugging that Sandel and his reviewers gave to viatical insurance, described as follows in the Guardian review: "These were insurance policies that had been taken out earlier in their lives by people who were dying of Aids. The life insurance policies of these dying patients were valuable – so a market developed in which these policies were bought by investors, who would give the Aids sufferer a lump sum and would pay for their care during the terminal illness. Then, when the patient died, the policy would pay out: kerching!"

I appreciate that this may, to some people, look a bit macabre. But for the life of me I can't see what's morally, or any other way, wrong with this market. Quite the reverse: it seems to me to be a rare example of a Pareto optimal outcome, where two groups are clearly better off (the dying people who get care they wouldn't otherwise have had, and investors, who get another option for their consideration), one group is completely unaffected (the insurance companies, who will pay out what they were always up for anyway), and nobody (that I can see) is worse off.

And I was sorry the section of the essay on "Economic Perspectives on the Achievement of Markets" (pp484 et seq) didn't give Walras at least a passing mention. I don't know what economics students get taught these days about general equilibrium, but in my undergraduate days we got a decent blast of Walras' imagined omniscient auctioneer, conducting auctions in all the markets of the economy, nudging prices up where supply was short of demand, nudging prices down where demand was short of supply, and through this 'tâtonnement' (groping) signalling and coordinating an entire economy towards an efficient equilibrium. They say there are mathematicians who weep at the beauty of the binomial theorem: I still get the same sense of awe at Walras' model.

I agree with one of Besley's conclusions, namely that Sandel does not appear to have a good answer to the question, (as Besley puts it, p489), "What are the alternatives to using the market?...If there are problems with using markets to allocate goods, then ultimately we have to say what we should do about it". And I'd just point to the quotes from Yarrow and Wheelan that I've got in the 'Welcome to my blog' sidebar.

And I was also rather baffled by the mugging that Sandel and his reviewers gave to viatical insurance, described as follows in the Guardian review: "These were insurance policies that had been taken out earlier in their lives by people who were dying of Aids. The life insurance policies of these dying patients were valuable – so a market developed in which these policies were bought by investors, who would give the Aids sufferer a lump sum and would pay for their care during the terminal illness. Then, when the patient died, the policy would pay out: kerching!"

I appreciate that this may, to some people, look a bit macabre. But for the life of me I can't see what's morally, or any other way, wrong with this market. Quite the reverse: it seems to me to be a rare example of a Pareto optimal outcome, where two groups are clearly better off (the dying people who get care they wouldn't otherwise have had, and investors, who get another option for their consideration), one group is completely unaffected (the insurance companies, who will pay out what they were always up for anyway), and nobody (that I can see) is worse off.

And I was sorry the section of the essay on "Economic Perspectives on the Achievement of Markets" (pp484 et seq) didn't give Walras at least a passing mention. I don't know what economics students get taught these days about general equilibrium, but in my undergraduate days we got a decent blast of Walras' imagined omniscient auctioneer, conducting auctions in all the markets of the economy, nudging prices up where supply was short of demand, nudging prices down where demand was short of supply, and through this 'tâtonnement' (groping) signalling and coordinating an entire economy towards an efficient equilibrium. They say there are mathematicians who weep at the beauty of the binomial theorem: I still get the same sense of awe at Walras' model.

Friday, 20 September 2013

Getting more value from consensus forecasts

Yesterday I posted a piece about how business people can squeeze value from the consensus economic forecasts compiled by the NZIER, and along the way I mentioned that it's useful to look at the range of views around the consensus average: "it's very helpful to see the spread of views, as it gives you some feel about the degree of uncertainty ahead".

By coincidence I was fossicking around today in the AEA journals, and came across "Uncertainty and Economic Activity: Evidence from Business Survey Data" (American Economic Journal: Macroeconomics 2013, 5(2): 217–249). I can't find a free link to the paper (or to other versions - it also appeared as an NBER Working Paper) but if you're an AEA member or your organisation has a subscription to the AEA journals, you can access it via the AEA's journals page. In any event here's the gist of it.

It found that the spread of opinions (in this case across respondents to German and American business opinion surveys) did indeed convey useful information about the degree of uncertainty around the economic outlook.

The authors looked at two measures derived from the surveys: one was an ex post one (the variance in how closely businesses' expectations for production matched their actual outcomes), and one was ex ante (the range of views across the businesses about expected production). And they found, first, that the two measures were closely correlated (a wider range of views in advance did indeed signal more bumpy outcomes later, where expectations had not been met), and that there were clear links between higher uncertainty (on either measure) and economic activity, and in an inverse way. When uncertainty rose, subsequent activity fell: big rises in uncertainty occurred, for example, just before recessions.

There's a lot more in this paper than the usefulness of paying attention to the range of views across businesses or forecasters. The authors look, for example, at what the transmission mechanisms are between that rise in uncertainty and subsequent weakness in activity, and find that for Germany it seems to be that firms go into "wait and see" mode, deferring hiring and investment, while in the US it's not so clear what's going on.

Bottom line, though, for people trying to navigate better through the economic cycle, is this: there's value in knowing what the consensus expectation is. But there's also real value in knowing how wide is the range of views around that consensus - and in particular, in noting if the range of views has suddenly got wider. It's not a good sign when it does.

By coincidence I was fossicking around today in the AEA journals, and came across "Uncertainty and Economic Activity: Evidence from Business Survey Data" (American Economic Journal: Macroeconomics 2013, 5(2): 217–249). I can't find a free link to the paper (or to other versions - it also appeared as an NBER Working Paper) but if you're an AEA member or your organisation has a subscription to the AEA journals, you can access it via the AEA's journals page. In any event here's the gist of it.

It found that the spread of opinions (in this case across respondents to German and American business opinion surveys) did indeed convey useful information about the degree of uncertainty around the economic outlook.

The authors looked at two measures derived from the surveys: one was an ex post one (the variance in how closely businesses' expectations for production matched their actual outcomes), and one was ex ante (the range of views across the businesses about expected production). And they found, first, that the two measures were closely correlated (a wider range of views in advance did indeed signal more bumpy outcomes later, where expectations had not been met), and that there were clear links between higher uncertainty (on either measure) and economic activity, and in an inverse way. When uncertainty rose, subsequent activity fell: big rises in uncertainty occurred, for example, just before recessions.

There's a lot more in this paper than the usefulness of paying attention to the range of views across businesses or forecasters. The authors look, for example, at what the transmission mechanisms are between that rise in uncertainty and subsequent weakness in activity, and find that for Germany it seems to be that firms go into "wait and see" mode, deferring hiring and investment, while in the US it's not so clear what's going on.

Bottom line, though, for people trying to navigate better through the economic cycle, is this: there's value in knowing what the consensus expectation is. But there's also real value in knowing how wide is the range of views around that consensus - and in particular, in noting if the range of views has suddenly got wider. It's not a good sign when it does.

Thursday, 19 September 2013

How to mine the consensus view

The latest consensus forecasts compiled by the NZ Institute of Economic Research (NZIER), were published this week, and it reminded me that a few years back I prepared a module on economics for directors, as part of the Institute of Directors' training courses. The module included some discussion on how to get the best of out these forecasts, from a practical business perspective, which I thought might be worth resurrecting.

First of all, for those unfamiliar with them, these consensus forecasts are the average forecast for a bunch of things, calculated from the forecasts of 10 different forecasters (two public sector, Treasury and the Reserve Bank, and the rest from a range of private sector financial institutions, including all the main banks, plus the NZIER itself).

The averaging is the first benefit of this exercise - there's evidence that the best forecasts, over time, are these averaged consensus ones. Individual forecasters can be all over the place - for example, as I noted earlier, there are currently quite different views among the big banks about how the Australian economy will fare - but the consensus tends to give a more reliable signal. If you're looking for some numbers to plug into your strategic planning, these are as good as any.

Next, the most important element is what the consensus is saying about the outlook for the economy as a whole. Have a look at Table 1. You can see in the columns headed 'Sept-2013 survey', that GDP growth is expected to be 2.6% in the year to March '14, 3.0% in the year to March '15, and 2.3% in the year to March '16. From a business point of view, is this good, bad or indifferent? It's reasonably good. It's enough, for example, as you can see lower in the table when you look at the forecasts for employment growth and for the unemployment rate, to lead to businesses hiring more people each year, on a scale enough to lead to a gradual modest decline in the number of people unemployed.

The next thing I tend to look at it is the change (if any) from the previous consensus. Table 1 helpfully compares the latest set (collated September) with the previous set (collected in June). Overall, this time round, there's no significant change. Sometimes, though, you'll find that economic prospects have improved or deteriorated quite a lot over the space of a quarter. When it happens, and there's been a positive or negative surprise, it's a useful thing to tuck away for planning or risk management purposes.

Next question to ask yourself is, what is this forecast economic growth principally based on? What's the biggest moving part? This time round, it's the very large forecast rise in 'Fixed investment - residential', or housebuilding in other words, which in turn reflects the scale of the Canterbury rebuild. That sounds like a reasonably high-probability bankable proposition: we know the rebuild is going to have to happen.

Other times, though, the forecasts may be based on expected strong growth in export markets, or on growth in government spending, and you need to know that's the basis of current expectations, especially if you have a different view (for example you're finding it tough in export markets at the current level of the Kiwi dollar but forecasters seem to be picking buoyant export markets) or there's a sudden shift in the winds (for example, a change in economic policy).

The consensus forecasts also show you the range of the forecasts: for each variable you can see the most optimistic and the most pessimistic view amongst the ten forecasters. The graphs on pp2-3 are the easiest way of seeing the range of views, and the numbers themselves are in Table 3. Again, it's very helpful to see the spread of views, as it gives you some feel about the degree of uncertainty ahead.

Looking at the GDP graph (below), you can see, for example, that there isn't a single forecaster predicting a recession on the horizon over the next three years. That's not to say they're going to be right - a squall of some kind could materialise out of the blue - but it's a reassuring feature of the forecasts nonetheless. On p3 you can see a similar consensus about inflation - everyone believes the low point is behind us, everyone believes inflation will pick up, but everyone also believes it won't breach the Reserve Bank's 3% maximum.

There's a similar consensus about short term interest rates: everyone expects they're on the way up (implicitly, they're expecting the Reserve Bank to be reacting to that anticipated rise in inflation). Ditto long term interest rates: if you're looking at that 'fixed or floating' interest rate decision, then Table 3 gives you some numbers for expected short and long term interest rates to go into your calculations.

There's also consensus about the overall value of the Kiwi dollar, but personally I don't pay too much to this forecast. For one thing, forecasting exchange rates tends to be an especially unreliable process in the first place (even on a consensus basis). And for another, exchange rate forecasters tend to make the same forecast over and over again: when a currency has been rising, they expect it to rise a bit more, but then decline (the picture, yet again, in these forecasts), and when a currency has been falling, they expect it to fall a bit more, and then rise.

The best that can be said about that shape of forecast is that forecasters have some idea of a long-term 'right' value for the Kiwi dollar, and the further the actual exchange rate has moved away from it, the more they expect it to turn back towards it next time. But you could also less charitably describe the forecasting as purely mechanical.

There's quite a lot of mutual agreement among the forecasters: is there anything where there's a wide spread of views? This time, there's some disagreement about the outlook for exports (graph, p2), but I don't think it means much for businesses. The range of views on exports is (I reckon) down to different views of the one-off impact of the past drought, and doesn't mean anything much for the future export outlook.

You'll find, though, that sometimes the uncertainties are more meaningful. When I first did this exercise for the Institute of Directors, there was considerable uncertainty about the outlook for wages (the economy was growing quite strongly at the time): one possible business response would be to take some of that potential cost volatility out of your business by agreeing on earlier than usual pay increases, or perhaps for longer terms.

There are other ways for folks in business to make productive use of these forecasts. One final one: let's take the year to March '15 as an example. In that year, the consensus forecast is for real GDP growth to be 3%, and the consensus forecast for inflation is for 2.2%. Implicitly, the forecast for growth in nominal GDP (i.e. GDP in everyday dollars) is 5.3% (there's a slight compounding effect that makes it 5.3% rather than the 5.2% you get by adding 3% and 2.2%). So what sort of number have you got in your sales forecasts for that year?

If it's less than 5.3%, you're saying that you're planning to do less well than the average other guy. If it's more than 5.3%, you're expecting to do rather better than firms as a whole. There might be good reasons for both views - but it's also good to know what judgement call you're implicitly making.

First of all, for those unfamiliar with them, these consensus forecasts are the average forecast for a bunch of things, calculated from the forecasts of 10 different forecasters (two public sector, Treasury and the Reserve Bank, and the rest from a range of private sector financial institutions, including all the main banks, plus the NZIER itself).

The averaging is the first benefit of this exercise - there's evidence that the best forecasts, over time, are these averaged consensus ones. Individual forecasters can be all over the place - for example, as I noted earlier, there are currently quite different views among the big banks about how the Australian economy will fare - but the consensus tends to give a more reliable signal. If you're looking for some numbers to plug into your strategic planning, these are as good as any.

Next, the most important element is what the consensus is saying about the outlook for the economy as a whole. Have a look at Table 1. You can see in the columns headed 'Sept-2013 survey', that GDP growth is expected to be 2.6% in the year to March '14, 3.0% in the year to March '15, and 2.3% in the year to March '16. From a business point of view, is this good, bad or indifferent? It's reasonably good. It's enough, for example, as you can see lower in the table when you look at the forecasts for employment growth and for the unemployment rate, to lead to businesses hiring more people each year, on a scale enough to lead to a gradual modest decline in the number of people unemployed.

The next thing I tend to look at it is the change (if any) from the previous consensus. Table 1 helpfully compares the latest set (collated September) with the previous set (collected in June). Overall, this time round, there's no significant change. Sometimes, though, you'll find that economic prospects have improved or deteriorated quite a lot over the space of a quarter. When it happens, and there's been a positive or negative surprise, it's a useful thing to tuck away for planning or risk management purposes.

Next question to ask yourself is, what is this forecast economic growth principally based on? What's the biggest moving part? This time round, it's the very large forecast rise in 'Fixed investment - residential', or housebuilding in other words, which in turn reflects the scale of the Canterbury rebuild. That sounds like a reasonably high-probability bankable proposition: we know the rebuild is going to have to happen.

Other times, though, the forecasts may be based on expected strong growth in export markets, or on growth in government spending, and you need to know that's the basis of current expectations, especially if you have a different view (for example you're finding it tough in export markets at the current level of the Kiwi dollar but forecasters seem to be picking buoyant export markets) or there's a sudden shift in the winds (for example, a change in economic policy).

The consensus forecasts also show you the range of the forecasts: for each variable you can see the most optimistic and the most pessimistic view amongst the ten forecasters. The graphs on pp2-3 are the easiest way of seeing the range of views, and the numbers themselves are in Table 3. Again, it's very helpful to see the spread of views, as it gives you some feel about the degree of uncertainty ahead.

Looking at the GDP graph (below), you can see, for example, that there isn't a single forecaster predicting a recession on the horizon over the next three years. That's not to say they're going to be right - a squall of some kind could materialise out of the blue - but it's a reassuring feature of the forecasts nonetheless. On p3 you can see a similar consensus about inflation - everyone believes the low point is behind us, everyone believes inflation will pick up, but everyone also believes it won't breach the Reserve Bank's 3% maximum.

There's a similar consensus about short term interest rates: everyone expects they're on the way up (implicitly, they're expecting the Reserve Bank to be reacting to that anticipated rise in inflation). Ditto long term interest rates: if you're looking at that 'fixed or floating' interest rate decision, then Table 3 gives you some numbers for expected short and long term interest rates to go into your calculations.

There's also consensus about the overall value of the Kiwi dollar, but personally I don't pay too much to this forecast. For one thing, forecasting exchange rates tends to be an especially unreliable process in the first place (even on a consensus basis). And for another, exchange rate forecasters tend to make the same forecast over and over again: when a currency has been rising, they expect it to rise a bit more, but then decline (the picture, yet again, in these forecasts), and when a currency has been falling, they expect it to fall a bit more, and then rise.

The best that can be said about that shape of forecast is that forecasters have some idea of a long-term 'right' value for the Kiwi dollar, and the further the actual exchange rate has moved away from it, the more they expect it to turn back towards it next time. But you could also less charitably describe the forecasting as purely mechanical.

There's quite a lot of mutual agreement among the forecasters: is there anything where there's a wide spread of views? This time, there's some disagreement about the outlook for exports (graph, p2), but I don't think it means much for businesses. The range of views on exports is (I reckon) down to different views of the one-off impact of the past drought, and doesn't mean anything much for the future export outlook.

You'll find, though, that sometimes the uncertainties are more meaningful. When I first did this exercise for the Institute of Directors, there was considerable uncertainty about the outlook for wages (the economy was growing quite strongly at the time): one possible business response would be to take some of that potential cost volatility out of your business by agreeing on earlier than usual pay increases, or perhaps for longer terms.

There are other ways for folks in business to make productive use of these forecasts. One final one: let's take the year to March '15 as an example. In that year, the consensus forecast is for real GDP growth to be 3%, and the consensus forecast for inflation is for 2.2%. Implicitly, the forecast for growth in nominal GDP (i.e. GDP in everyday dollars) is 5.3% (there's a slight compounding effect that makes it 5.3% rather than the 5.2% you get by adding 3% and 2.2%). So what sort of number have you got in your sales forecasts for that year?

If it's less than 5.3%, you're saying that you're planning to do less well than the average other guy. If it's more than 5.3%, you're expecting to do rather better than firms as a whole. There might be good reasons for both views - but it's also good to know what judgement call you're implicitly making.

Friday, 13 September 2013

Six interesting graphs from yesterday's Monetary Policy Statement

I know, you don't need another description of the monetary policy decision, or analysis of whether it's right or wrong, and you're not going to get one. Instead here are some graphs from the Monetary Policy Statement which I thought were interesting insights into how our economy is behaving.

Here's the first one.

I've seen similar pictures over the years, and every time I do, it bothers me. Look at that 'Non-tradables' inflation line. There's a stubborn structural persistence to our domestically-generated inflation: indeed, on the RBNZ's projections, domestically generated inflation will be running at around 3-4% a year from 2014 onwards. I appreciate that a lot of the non-tradables sectors don't benefit from the large productivity gains that can occur in some of the tradable sectors (eg much more bang for your buck across all sorts of ICT and electronic gear) and which helps keep tradables inflation lower than non-tradables inflation. But you'd still wonder if there isn't a slab of the domestic economy that still feels it can jack up prices with ease, unconstrained by competition.

Here's the second one.

If the first graph left you wondering about some structural rigidities in the New Zealand economy, this one gives you more optimism about flexibility. Real wages are clearly flexible, and track the cycle closely, slowing when there's excess capacity (i.e. on the graph when the output gap is in negative territory) and picking up in better times.

Here's the third one.

The point here is to show how useful business opinion surveys are (something I've noted before, here and here). On their surface they look very simple tools - asking businesspeople generally qualitative questions, and graphing the net balances that result (eg percentage optimistic less percentage pessimistic). And yet they systematically generate highly reliable and (I would argue) sophisticated insights into the cycle. In the graph, you've got the RBNZ's measure of the output gap, which is derived from some very fancy econometrics, and you've also got what the RBNZ calls the 'QSBO cyclical indicator', which is a combination of various capacity readings from the NZIER's Quarterly Survey of Business Opinion. In the end, they turn out to be virtually identical. The yes/no/maybe answers turn out to be just as accurate as the heavy duty econometrics.

Here's the fourth one.

This, I thought, was a nice way to illustrate the supply/demand dynamics in the Auckland housing market. The red line is the ratio of house sales to house listings, and (obviously enough) it rises when houses are selling faster than the stock of listings is, i.e. demand is growing faster than supply. And, as you'd expect, there's a strong link between this demand/supply indicator and house prices.

Here's the fifth one.

It shows the amount of earthquake reconstruction the RB expects, as a percentage of GDP. That's interesting in itself, but what's somewhat worrying me is the proportion of total GDP growth it represents. Over 2014-16 the RB expects GDP growth to average 2.6% a year: over the same period the rebuild is worth about 1.6% of GDP a year. That means the rest of the economy isn't doing much at all. Maybe all this is saying is that the economy has a short-run capacity constraint: we can rebuild Canterbury, and we can do a bit more of other stuff, and that's it. Fair enough, but I wonder if this graph leaves you with the same niggling thought it's left with me: absent the rebuild, what sort of longer-term growth rate is the economy capable of sustaining?

Here's the first one.

I've seen similar pictures over the years, and every time I do, it bothers me. Look at that 'Non-tradables' inflation line. There's a stubborn structural persistence to our domestically-generated inflation: indeed, on the RBNZ's projections, domestically generated inflation will be running at around 3-4% a year from 2014 onwards. I appreciate that a lot of the non-tradables sectors don't benefit from the large productivity gains that can occur in some of the tradable sectors (eg much more bang for your buck across all sorts of ICT and electronic gear) and which helps keep tradables inflation lower than non-tradables inflation. But you'd still wonder if there isn't a slab of the domestic economy that still feels it can jack up prices with ease, unconstrained by competition.

Here's the second one.

If the first graph left you wondering about some structural rigidities in the New Zealand economy, this one gives you more optimism about flexibility. Real wages are clearly flexible, and track the cycle closely, slowing when there's excess capacity (i.e. on the graph when the output gap is in negative territory) and picking up in better times.

Here's the third one.

The point here is to show how useful business opinion surveys are (something I've noted before, here and here). On their surface they look very simple tools - asking businesspeople generally qualitative questions, and graphing the net balances that result (eg percentage optimistic less percentage pessimistic). And yet they systematically generate highly reliable and (I would argue) sophisticated insights into the cycle. In the graph, you've got the RBNZ's measure of the output gap, which is derived from some very fancy econometrics, and you've also got what the RBNZ calls the 'QSBO cyclical indicator', which is a combination of various capacity readings from the NZIER's Quarterly Survey of Business Opinion. In the end, they turn out to be virtually identical. The yes/no/maybe answers turn out to be just as accurate as the heavy duty econometrics.

Here's the fourth one.

This, I thought, was a nice way to illustrate the supply/demand dynamics in the Auckland housing market. The red line is the ratio of house sales to house listings, and (obviously enough) it rises when houses are selling faster than the stock of listings is, i.e. demand is growing faster than supply. And, as you'd expect, there's a strong link between this demand/supply indicator and house prices.

Here's the fifth one.

'PLT' means 'Permanent and Long-Term' migration of New Zealand citizens. And it shows some interesting patterns - we're still, net, losing people to Australia, but it's down from around 10,000 people a quarter in 2011 to more like 6,000 people a quarter now, as both fewer people are leaving and more people are coming back. And in turn that reflects (as the RB pointed out) a cyclical upswing here and a cyclical slowdown over there. More generally it shows the progressive integration of our two economies and the ability of people to make shrewd assessments of the two labour markets.

And finally there's this.

Thursday, 12 September 2013

What will fast broadband mean for you?

As my previous post on the latest developments in broadband pricing noted (and which, somewhat to my surprise, generated an unusually large number of page views), there is quite a range of opinion in the marketplace about the potential benefits of our new Ultra Fast Broadband (UFB) fibre network.

Some folks reckon that the potential economic and social benefits are so large that everything possible needs to be done to get the fibre rolled out ubiquitously and quickly, and that policies should be aimed to maximise early and extensive uptake of the new fibre-based broadband. They also point to the potential for strong network effects - the more people sign up, and the quicker, the more each one benefits from the presence of many others.

Others range from agnostic - broadband could well pay off, but it's uncertain what the payoffs will be or in what areas - through to the sceptical: the costs are high, whereas the benefits are arguably limited and distant.

It never hurts to have some evidence when you've got debates like these, and I've just come across a brand new study that's attempted to estimate what the payoffs might be to households from the likes of UFB. I haven't seen much coverage of it in New Zealand, so I thought I'd draw people's attention to it. It was done for Australia's Department of Broadband, Communications and the Digital Economy by Deloitte Access Economics. You can download it from Deloitte's site.

Here's the guts of the thing. Access Economics found that the benefits to the average Australian household, in today's money, would be worth about A$3,800 a year in 2020. This was on the assumption, by the way, that the Aussie version of our UFB, the NBN (the National Broadband Network), would be rolled out as the outgoing Labor government planned, with fibre all the way to your home, rather than (as the incoming Coalition government prefers as a cheaper option) fibre 'to the node', i.e. to a cabinet in your street, with a copper connection from there to your home.

Access found that roughly two-thirds of the benefit (A$2,400) would be money in your hand, one way or another, and the other third is their estimate of the implicit money value of things like time saved travelling. Around half of the total A$3,800 comes in that 'Productivity > Lower prices, better quality' line. This, Access say, "is made up of price reductions, improvements in quality, changes in wages, and higher profits from businesses they own". In turn those higher wages and profits come from an assumed economy-wide 1.1% of GDP productivity gain from the NBN, which in turn is consistent with the results from a study done for the World Bank on the 'Economic Impacts of Broadband'.

Access reproduce a key finding from that research, which I've also shown below.

Access commented that "The Qiang analysis [shown above] found that the economic impact of each ICT innovation was larger than all those previously...and that differences in broadband penetration among countries may generate long-run gains to overall economic growth for those that are

early adopters".

The Access study also breaks out (in Chapter 3) some detailed illustrations of how NBN/UFB would affect households of different kinds. They find that the benefits vary very widely from one set of family circumstances to another, and that there is "some evidence that the scenarios with greater impacts are where households face difficult circumstances, such as needing to find employment, move residence or where additional education is of significant benefit. This could suggest that broadband has the potential to play a role in improving opportunities for those in society facing disadvantage".

What should we make of this?

I suspect that I'm in the same place as many of you: I don't know (yet, and maybe never) what the payoffs from UFB might be, or whether they're worth the multi-billion-dollar gamble. As I've suggested before, there are times when I think it's worth rolling the dice, even when the stakes are large and speculative, and UFB could well be one of those times, and I also think that UFB or the like is going to be the stake you have to put on the table to play at being internationally competitive. I'm probably somewhere on the upbeat side of UFB-agnostic, and to that extent this latest research sits comfortably with that kind of view.

All that said, obviously one bit of research is far from the last word on anything. That's not to dismiss it. It's a solid-looking effort: I trekked through the various assumptions and calculations they made, and they look reasonably well-grounded to me (though if some kind reader can make a better fist of putting plainer English around their 'elasticity of substitution' line of reasoning than they have, I'd like to hear from you). And it likely leads you to think more about the upside aspects of UFB, though even if you conclude, "UFB is a corker of a plan", that still leaves you with some tricky policy issues about both copper and fibre.

In any event, it's got to go into the pot with whatever other evidence comes to hand. My plan from here is to post more good research on UFB and see where the results take us.

Incidentally, and I appreciate it's somewhat off-topic, this Access Economics research illustrates one of the core strengths of economics. Economics (particularly macroeconomics) and economists have to some extent become an easy target for post-GFC activists looking to substitute their approach (typically non-market) for ours. But when a government comes to place a couple of billion dollars bet on the likes of a UFB, it's worth noting that we still have the analytical tools and quantitative skills to help throw light on the bigger policy issues of the day.

Some folks reckon that the potential economic and social benefits are so large that everything possible needs to be done to get the fibre rolled out ubiquitously and quickly, and that policies should be aimed to maximise early and extensive uptake of the new fibre-based broadband. They also point to the potential for strong network effects - the more people sign up, and the quicker, the more each one benefits from the presence of many others.

Others range from agnostic - broadband could well pay off, but it's uncertain what the payoffs will be or in what areas - through to the sceptical: the costs are high, whereas the benefits are arguably limited and distant.

It never hurts to have some evidence when you've got debates like these, and I've just come across a brand new study that's attempted to estimate what the payoffs might be to households from the likes of UFB. I haven't seen much coverage of it in New Zealand, so I thought I'd draw people's attention to it. It was done for Australia's Department of Broadband, Communications and the Digital Economy by Deloitte Access Economics. You can download it from Deloitte's site.

Here's the guts of the thing. Access Economics found that the benefits to the average Australian household, in today's money, would be worth about A$3,800 a year in 2020. This was on the assumption, by the way, that the Aussie version of our UFB, the NBN (the National Broadband Network), would be rolled out as the outgoing Labor government planned, with fibre all the way to your home, rather than (as the incoming Coalition government prefers as a cheaper option) fibre 'to the node', i.e. to a cabinet in your street, with a copper connection from there to your home.

Access found that roughly two-thirds of the benefit (A$2,400) would be money in your hand, one way or another, and the other third is their estimate of the implicit money value of things like time saved travelling. Around half of the total A$3,800 comes in that 'Productivity > Lower prices, better quality' line. This, Access say, "is made up of price reductions, improvements in quality, changes in wages, and higher profits from businesses they own". In turn those higher wages and profits come from an assumed economy-wide 1.1% of GDP productivity gain from the NBN, which in turn is consistent with the results from a study done for the World Bank on the 'Economic Impacts of Broadband'.

Access reproduce a key finding from that research, which I've also shown below.

Access commented that "The Qiang analysis [shown above] found that the economic impact of each ICT innovation was larger than all those previously...and that differences in broadband penetration among countries may generate long-run gains to overall economic growth for those that are

early adopters".

The Access study also breaks out (in Chapter 3) some detailed illustrations of how NBN/UFB would affect households of different kinds. They find that the benefits vary very widely from one set of family circumstances to another, and that there is "some evidence that the scenarios with greater impacts are where households face difficult circumstances, such as needing to find employment, move residence or where additional education is of significant benefit. This could suggest that broadband has the potential to play a role in improving opportunities for those in society facing disadvantage".

What should we make of this?

I suspect that I'm in the same place as many of you: I don't know (yet, and maybe never) what the payoffs from UFB might be, or whether they're worth the multi-billion-dollar gamble. As I've suggested before, there are times when I think it's worth rolling the dice, even when the stakes are large and speculative, and UFB could well be one of those times, and I also think that UFB or the like is going to be the stake you have to put on the table to play at being internationally competitive. I'm probably somewhere on the upbeat side of UFB-agnostic, and to that extent this latest research sits comfortably with that kind of view.

All that said, obviously one bit of research is far from the last word on anything. That's not to dismiss it. It's a solid-looking effort: I trekked through the various assumptions and calculations they made, and they look reasonably well-grounded to me (though if some kind reader can make a better fist of putting plainer English around their 'elasticity of substitution' line of reasoning than they have, I'd like to hear from you). And it likely leads you to think more about the upside aspects of UFB, though even if you conclude, "UFB is a corker of a plan", that still leaves you with some tricky policy issues about both copper and fibre.

In any event, it's got to go into the pot with whatever other evidence comes to hand. My plan from here is to post more good research on UFB and see where the results take us.

Incidentally, and I appreciate it's somewhat off-topic, this Access Economics research illustrates one of the core strengths of economics. Economics (particularly macroeconomics) and economists have to some extent become an easy target for post-GFC activists looking to substitute their approach (typically non-market) for ours. But when a government comes to place a couple of billion dollars bet on the likes of a UFB, it's worth noting that we still have the analytical tools and quantitative skills to help throw light on the bigger policy issues of the day.