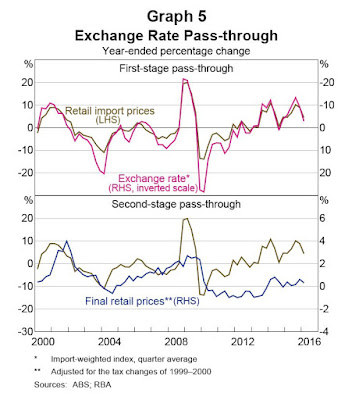

The authors wanted to find out why inflation in the Aussie shops was running lower than would have been expected, given the level of the Aussie dollar, as can be seen in the graph below, where the dark blue line (inflation) has been lagging below the pinky-purply one (the changing value of the A$).

And when they looked at it more closely they discovered an interesting thing. They disentangled what happens when exchange rates change. There are two steps: the first is the impact on the landed Aussie cost of imports (which goes up when the A$ falls and down when it rises), and the second stage is what happens to that changed landed cost of imports as it works its way through the wholesale and retail domestic distribution chain.

What they found was that the first stage hadn't changed at all: a lower A$, for example, was still feeding through to higher landed A$ costs of imports, just as it always did. But the second stage had changed quite a lot: from about 2010 onwards, there was less pass-through of those higher import costs into final consumer prices, as the graph below shows.

They weren't able to nail what had changed in the second stage using econometric methods, other than to confirm that statistical tests did indeed confirm a change in behaviour, so they had a qualitative fossick instead, based on what the RBA had been picking up from its regular programme of going round and talking to businesses ('liaison' in central bank geekspeak).

Increased competition appears to have been the reason (my emphasis added):

They also found an interesting phenomenon where in a number of sectors, there was an especially aggressive competitor who was making life tough for the rest of the players:Liaison with retailers suggests that over the period of interest, competition in the retail sector has intensified, partly due to increased supply. There are numerous sources of this increase in competitive pressures, although some key themes have emerged from liaison.• Technology has enabled consumers to compare retail prices quickly and easily online and determine which retailer(s) are offering the lowest prices. The increasing online presence of traditional bricks-and-mortar retailers is contributing to this effect.• Relatedly, the supply of retailers has increased due to competition from foreign online retailers. This was particularly evident over 2010–13 when the exchange rate was relatively high...Over this period, domestic retailers became relatively less competitive against competitors based offshore.• Both established firms and new entrants, including international retailers entering the Australian market, are competing aggressively to gain market share

Competition in turn was forcing firms to improve their efficiency if they wanted to maintain previous levels of profitability, pushing them to look for "labour productivity gains through technological improvements, such as contactless payments systems, self-serve checkouts and better monitoring of staffing needs" and "other means, such as bargaining for lower rents, improving inventory management, sourcing from fewer suppliers, partnering with other firms to lower distribution costs and centralising some administration tasks".In a number of market segments, liaison has attributed the increase in retail competition to the actions of a perceived ‘market leader’, which is generally looking to expand their market share, effectively increasing supply. This has led a number of retailers to report that they believe demand for their goods is very price sensitive, and fear that they will lose sales volumes if they increase prices. Earlier work on Australian retailers found that a majority of firms primarily set prices based on the balance of supply and demand factors, such as market conditions or competitors’ prices, rather than setting prices as a fixed mark-up over costs

What a nice textbook outcome from increased competitive pressures: consumers have got a better deal, and producers have been pushed to improve their productivity. And it comes in a week where the latest instalment of MBIE's electricity price monitoring showed that retail electricity prices had dropped for the first time in 15 years, which MBIE said "was driven by increased discounting activity and incentive credits" - greater competition, in other words. Carl Hansen, the CEO at the Electricity Authority, said that the price fall "is one of the many indicators of strong competition in [the] residential electricity market. Another indicator is that smaller retailers have now grown their market share to 10 per cent which is putting significant pressure on the larger retailers".

It may be making a meal of the obvious, that competition is pro-consumer and pro-productivity, but the message doesn't always get through in New Zealand, or elsewhere. The lobbyists for the quiet life in sectors such as education, health and the professions are good at running the pro-producer line, and (like in bunfights over trade protectionism) the voice of the consumer doesn't get the hearing it should.

We need more competition across more markets, and you don't have to take just my word for it. The OECD, in the chapter on New Zealand in the latest update of its Economic Outlook, said that "Reducing barriers to FDI [foreign direct investment] and to competition in the electricity, transport and telecoms sectors would facilitate greater investment and innovation, increasing productivity and reducing prices". There's work to do if we're going to have the retail price and producer productivity benefits Australia is enjoying, and more of our utility bills going down.

Interesting post Donal.

ReplyDeleteThis sounds like a case of weakening cost pass-though from upstream to downstream prices. One often forgotten (and counter intuitive) theoretical result is that the more retail competition there is (ie prices closer to marginal costs), the more cost pass-through there is. For example, under perfect competition, if retailers' marginal costs increase by $1 across the board due to exchange rates, their end prices will also increase by $1, all else equal. A monopoly retailer will increase prices by less than $1.

This suggests that the effect of increased retail competition in reducing retail costs (other than forex effects) must be dominating the increased cost pass-through that increased competition creates.

Interested in your take.

Cheers

Diego

Thanks very much for the comment. Yes, you're right about markups under perfect competition and under monopoly, and I think your final sentence must be right, too.

ReplyDeleteThe problems arise in trying to disentangle a bunch of stuff that is happening simultaneously: if I had a criticism of the RBA paper, it would be that they recognised that companies set prices partly in terms of how they see demand and supply conditions, but to model the state of the cycle the authors used firms' expected inflation rate. This seemed rather odd to me, as they could (I think) have used direct measures such as firm's expected levels of activity in coming months (available in, say, the NAB business opinion surveys). So I think they're missing something about cyclical expansion and contraction of margins - if you look at the 1st graph I posted (headed 'Graph 2' by the authors) you can see big spikes in final retail prices in 1996 and 2002 that were much larger than could be accounted for by A$ moves. I suspect that business conditions were good enough (and competition less then) for companies to get away with unusually high increases. We don't have a complete explanation of everything, though the qualitative info the RBA turned up sounded v convincing and is surely part of the explanation. I also suspect that post GFC price (and wage) setting may be different to pre GFC - the appetite to chance your arm with price moves that could go wrong is a good deal less (I think) that it was pre GFC.

Incidentally another commenter (on Twitter) suggested that ALDI arriving may well be part of the increased competitive pressure. They first arrived in 2001 but would have made a big impact only later in the piece, which fits the timing.