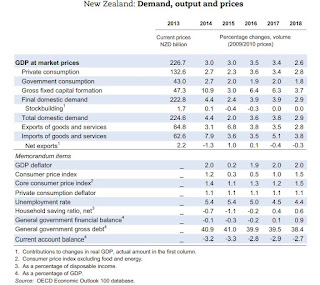

...and here's its pick for what will happen to New Zealand.

A forecast is a forecast is a forecast, and who knows what will actually come to hand. But if anything like this reasonably educated guess fronts up, we're in for a couple of good years. Growth will be faster than the OECD average, inflation lower, unemployment well below the OECD's, and our fiscal books in much better shape. There are aspects of it that could be better - we don't have a great long-term future if unemployment is low mainly because we're all busy clearing up after the latest earthquake - but it would still be a pretty good outcome to bag.

What slightly disappoints me is that we may be missing an opportunity to make things even better. One of the OECD's recommendations in their country forecast for New Zealand is that, given that there is "considerable scope to improve infrastructure" - don't we know it - "Government planning should begin now to establish a pipeline of good quality projects, including to promote productivity-enhancing urban densification and to service the rapidly expanding housing stock".

I'd assumed that we already had the pipeline they're talking about - in fact, we are issuing progress reports (like this latest one) on a Thirty Year plan first published last year - so I'm not entirely sure what the OECD is on about. I hope there isn't a gap between what we've currently got in mind and what the OECD thinks we should be doing.

In any event, whatever we, or the OECD, have got in mind, we should have been getting on with it while the going was exceptionally good. There was the opportunity to finance infrastructure at all-time historically cheap interest rates: our 10 year government stock yield hit an all-time low of 2.12% in mid August, and there was a very good chance that we could also have got 20, 25 or 30 year bonds away at very sharp rates indeed while world markets were obsessed with the proverbial "hunt for yield".

We've missed the very best opportunity to fill our boots with exceptionally cheap financing and build useful productivity-enhancing stuff with it: our 10 year government bond yield has already risen to over 3% (3.07% currently), following the post-Trump rise in US Treasury yields. Even so, the rates are still attractive by historical standards. We should pull finger and get the hell on with it while the going is still pretty good.

No comments:

Post a Comment

Hi - sorry about the Captcha step for real people like yourself commenting, it's to baffle the bots