The economy's ticking along nicely. Tomorrow's GDP numbers for the September quarter are expected to show an 0.8% increase for the quarter, which would make it 3.6% for the year. And virtually all the recent data have been solid to robust. On the solid side, for example, there's the December quarter Westpac McDermott Miller consumer confidence index ("New Zealand households are in the mood to celebrate. However, it looks like the party will be more of a relaxing family barbeque, rather than a fullblown rager") while down the robust end we've had the latest (November) BusinessNZ/BNZ Performance of Services Index ("a picture of strength"). In per capita terms, it's not the boomer it might look like at first sight, and I'll come to that, but it's still a pretty picture.

Unsurprisingly, forecasters have been upping their estimates of what's down the track. The latest (December) quarterly consensus forecasts collated by the NZ Institute of Economic Research showed that likely GDP growth in the year to next March is now reckoned to be 3.5% (the September quarter consensus had picked 3.2%) and there has been a marked revision upwards for likely employment growth, which is now expected to be a stonking 4.8% compared with the 3.2% that seemed the best guess back in September. Forecasts for growth and employment over the three years to March '20 have been nudged a bit higher, and there isn't a single forecaster (out of the 9 polled) prepared to call a recession over that period.

But you knew that. What's my point? It's this: I reckon the short-term outlook may be even stronger than people currently expect.

Recently I've been playing around with my little Excel forecasting model, and I can't easily get the GDP growth numbers for the next year much below 4%. I've assumed there will be some kind of wealth effect on consumer spending, and I've assumed that there is enough capacity in the building trades to allow for another reasonably substantial rise in housebuilding. If that's your view of the world, numbers north of 4% start shimmering into view. Interestingly, according to the ANZ confidence surveys (for example, here), "Our confidence composite gauge (which combines business and consumer

sentiment) is pointing to GDP growth accelerating to north of 4%.

Capacity constraints (getting skilled labour) will put a dampener on that but

we like the spirit".

I could easily be wrong. Perhaps New Zealand households have suddenly had an outbreak of financial prudence, or as RBNZ governor Graeme Wheeler put it in a recent speech, "Growth in real consumption per capita has averaged 1.6 percent pa in the current economic cycle – about ½ percentage point below the post-1993 average growth rate of 2.1 percent, despite the rapid increase in housing wealth...This more cautious consumer behaviour may reflect a reassessment of the ‘permanency’ of capital gains from household assets, and greater caution about the level and durability of future income growth".

Maybe. But I'd still be rather surprised if families, sitting on the biggest financial bonus of their lifetimes (especially in Auckland), continued to spend more slowly than usual. They may well (sensibly) discount the scale and the ultimate bankability of their winnings. But I don't see some wealth-related spendup being delayed for ever. Sure, some of it won't flow through to the GDP numbers: the new car and the trip to Melbourne go into the 'imports' box. But some of it will.

And on the capacity side, things are certainly tighter than they were: you could certainly read Stats' numbers on the recent slowdown in the growth of housebuilding (and of construction on general) as evidence that it's getting harder to assemble the crew for the next project. But on the other hand residential construction as a percentage of GDP isn't even up to past levels yet, as the chart below shows, and given the intense profit incentives to get houses onto the market, you'd expect us to go past previous peaks. My guess is that there's a dance in the old dame yet. And I also suspect (based on the technical economic methodology of Walking With Your Eyes Open Around The North Shore) that houses are going up quicker, which will help.

An economy that could well grow by 4.0% to 4.5% rather than the 3.5% that most analysts see in the cards would also part-explain a bit of an oddity - our low per capita GDP growth. In the June quarter our GDP (expenditure basis) was 3.8% up on a year earlier - but up by only 1.7% on a per capita basis. That was because the population grew by 2.1% (a natural increase of 28,200 plus net immigration of 69,100).

You look at that 1.7% per capita growth, and you could think two things. One is that it carries on our run of relatively slow productivity growth, and that's got to be right to some extent. But you could also think: hang on a sec. This isn't an economy with the look and feel of distinctly modest per capita growth. I appreciate that's an impressionistic judgement call, but I suspect the other leg to the apparently low per capita growth numbers is that they're a bit behind the actual pace of where the economy is (and is heading next).

It doesn't mean we've suddenly solved our slow-growth productivity problems. If anything, our reliance on construction in this cycle points them up: what we gonna do when the houses are up and the earthquake damage is fixed? And it doesn't mean that tomorrow's GDP number is going to be a little purler (any single quarter tends to have lumps in it). And 2016 was the year that gave us Brexit and Trump, so who knows what the next madness will be or what it might do to us. But net net net, it wouldn't be too surprising if the next six to twelve months turned out rather better than currently expected.

Wednesday, 21 December 2016

Sunday, 18 December 2016

Good books - December '16

Surrounded by "isn't it awful", "the world is going to the dogs" types? Here are two antidotes: Nobel laureate Angus Deaton's The Great Escape: Health, Wealth and the Origins of Inequality and Johan Norberg's Progress: Ten Reasons to Look Forward to the Future. Both document the immense progress made in the past three hundred years by large parts of the world on multiple fronts - not just in living standards, but also in health, longevity, literacy, freedom, peace and global equality. Deaton's book in particular will remind you that a prime reason many poor countries have missed out is political: they are kleptocrat tyrannies (another reminder, if you haven't yet, to read Acemoglu and Robinson's Why Nations Fail), which is one of the reasons why Deaton is critical of foreign aid (it keeps the Mugabes going). He's got better ideas on how to help them, including making trade with the developed world easier. And Norberg is full of interesting facts, including that "285,000 more people have gained access to safe water every day for the past 25 years", and that 2,000 more people will have escaped from poverty in the time it takes you to read his first chapter.

I didn't profit from George Lakey's recent Viking Economics: How the Scandinavians Got It Right - and How We Can, Too. It's as if he went on a Seventies demo, fell asleep mid-chant - "The workers! United! Will never be.." - and woke up yesterday. And while good ideas on economic policy can and should come from anywhere and anyone, sociology isn't where I'd go looking first. It doesn't help that the "we" in the title is "the US", not "everyone", which means that when he compares Nordic health systems with America's, they're better, but then, whose isn't? So it's hard to draw conclusions about Nordic implications for everyone else. I'm pretty sure there are some good Scandinavian ideas we could pirate (particularly the Danish 'flexicurity' of jobs, and possibly the Finns' education ideas), but I wouldn't use this book as the instruction manual.

If you did want a good guide, try Helen Russell's The Year of Living Danishly: Uncovering the secrets of the world's happiest country. Great armchair travel from a very good freelance writer. One interesting fact is that by international standards Denmark is a high trust society - you can, and they do, leave your baby in the pram outside the restaurant - which is one reason they tolerate the government taking 54.6% of GDP: they trust their representatives to do the right thing with it. More than I could say about any recent New Zealand (or Aussie, British or Irish, let alone American) governments.

Speaking of Aussies, we don't get enough mainstream media coverage of their politics other than at moments of high drama (though there have been a fair few of those recently). I liked Annabel Crabb's Stop at Nothing: The Life and Adventures of Malcolm Turnbull: concise, punchy, well-informed. The back jacket summarises Turnbull as "colourful, aggressive, humorous and ruthless" in his pre-politics days, and looks at whether he's changed much since: not a lot, I'd say. He's also a good deal more interesting as a person than I'd imagined: it may not help his liberal-trapped-in-a-conservative-party day job much, but he'd make a good addition to most pub quiz teams.

Timothy Garton Ash's The File: A personal history is the story of what he finds when he reads the file the East German Stasi security service kept on him. He comes to a relatively generous conclusion about the 2% of the East German population who were informers for the Stasi - "What you find, here in the files, is how deeply our conduct is influenced by our circumstances...What you find is less malice than human weakness...when you talk to those involved, what you find is less deliberate dishonesty than our almost infinite capacity for self-deception" - without losing sight of the big point: "Yet the sum of all their actions was a great evil".

Boston must be the setting for more good thrillers per square mile than anywhere on the planet, the latest being Michael Harvey's Brighton (a Boston locality) where a Pulitzer prize winning journalist who'd escaped the poor Catholic Irish 'burb comes back to help his teenage friend, who is suspected of several murders. The blurb on the cover says "riveting and elegiac", and it is: fine writing. Harvey's also got a series about a Chicago based private eye, Michael Kelly: I've read the fifth of them, The Governor's Wife, which was also very good.

University of Wolverhampton professor Gary Sheffield has come out with Douglas Haig: From the Somme to Victory, an updated and revised version of his earlier (2011) The Chief: Douglas Haig and the British Army. It's a balanced account that gives Haig more credit than he usually gets, and particularly on the logistical side of running an enormous enterprise. As Sheffield notes (pp154-5), at its peak the British army in France had to feed 2,700,000 men: "To keep one division in the field for one day required 'nearly 200 tons dead weight of supplies', and Haig's army consisted of more than 60 divisions". Haig as chief executive comes out well; Haig as general, somewhat well, though I haven't been entirely shifted from the "lions led by donkeys" camp. You could argue that Haig's "one last push and we'll break though into open country" was indeed finally vindicated, but too many people died to get there. Then again, it's also hard to shake the thought that, with the technologies of the day, there was little alternative to an attritional strategy, however appalling the casualties became.

Military historian Allan Mallinson doesn't like the "lions led by donkeys" line (it's "facile"), but in his Too Important for the Generals: Losing and Winning the First World War he's not impressed by the generals' strategic grip: "nothing can acquit the high command of its failure to see beyond no-man's-land [on the Western Front] and its embrace of the 'strategy of attrition" (p330). He also believes that the politicians should have taken a stronger hold of the overall direction of the war, and in particular gone for more flanking initiatives (like a better run Dardanelles operation) as well as boosting support for Russia and Serbia, rather than letting Russia slide into revolution and Serbia lose to Austria. All of which reflects the still unsettled scholarship on the Great War: you no sooner read one book suggesting the generals were doing as well as they could than the next suggests the opposite.

In brief: anything Robert Harris turns his hand to (the life of Cicero; a dystopian world where Hitler won) is highly readable. You'll like Conclave, which (natch) is about a papal election. Carl Hiaasen's written a series of high-paced comic novels about Florida bizarrenesses: his latest, Razor Girl, is right up with the rest of them. And if you like private eye novels set back in the Roman Empire - and let's face it, who wouldn't - you've probably worked your way through Lindsey Davis' Falco and Flavia Albia series and John Maddox Roberts' SPQR series, but don't miss the equally good Russo ones by Ruth Downie. I've just finished the latest, the fifth in the series, Vita Brevis.

I didn't profit from George Lakey's recent Viking Economics: How the Scandinavians Got It Right - and How We Can, Too. It's as if he went on a Seventies demo, fell asleep mid-chant - "The workers! United! Will never be.." - and woke up yesterday. And while good ideas on economic policy can and should come from anywhere and anyone, sociology isn't where I'd go looking first. It doesn't help that the "we" in the title is "the US", not "everyone", which means that when he compares Nordic health systems with America's, they're better, but then, whose isn't? So it's hard to draw conclusions about Nordic implications for everyone else. I'm pretty sure there are some good Scandinavian ideas we could pirate (particularly the Danish 'flexicurity' of jobs, and possibly the Finns' education ideas), but I wouldn't use this book as the instruction manual.

If you did want a good guide, try Helen Russell's The Year of Living Danishly: Uncovering the secrets of the world's happiest country. Great armchair travel from a very good freelance writer. One interesting fact is that by international standards Denmark is a high trust society - you can, and they do, leave your baby in the pram outside the restaurant - which is one reason they tolerate the government taking 54.6% of GDP: they trust their representatives to do the right thing with it. More than I could say about any recent New Zealand (or Aussie, British or Irish, let alone American) governments.

Speaking of Aussies, we don't get enough mainstream media coverage of their politics other than at moments of high drama (though there have been a fair few of those recently). I liked Annabel Crabb's Stop at Nothing: The Life and Adventures of Malcolm Turnbull: concise, punchy, well-informed. The back jacket summarises Turnbull as "colourful, aggressive, humorous and ruthless" in his pre-politics days, and looks at whether he's changed much since: not a lot, I'd say. He's also a good deal more interesting as a person than I'd imagined: it may not help his liberal-trapped-in-a-conservative-party day job much, but he'd make a good addition to most pub quiz teams.

Timothy Garton Ash's The File: A personal history is the story of what he finds when he reads the file the East German Stasi security service kept on him. He comes to a relatively generous conclusion about the 2% of the East German population who were informers for the Stasi - "What you find, here in the files, is how deeply our conduct is influenced by our circumstances...What you find is less malice than human weakness...when you talk to those involved, what you find is less deliberate dishonesty than our almost infinite capacity for self-deception" - without losing sight of the big point: "Yet the sum of all their actions was a great evil".

Boston must be the setting for more good thrillers per square mile than anywhere on the planet, the latest being Michael Harvey's Brighton (a Boston locality) where a Pulitzer prize winning journalist who'd escaped the poor Catholic Irish 'burb comes back to help his teenage friend, who is suspected of several murders. The blurb on the cover says "riveting and elegiac", and it is: fine writing. Harvey's also got a series about a Chicago based private eye, Michael Kelly: I've read the fifth of them, The Governor's Wife, which was also very good.

University of Wolverhampton professor Gary Sheffield has come out with Douglas Haig: From the Somme to Victory, an updated and revised version of his earlier (2011) The Chief: Douglas Haig and the British Army. It's a balanced account that gives Haig more credit than he usually gets, and particularly on the logistical side of running an enormous enterprise. As Sheffield notes (pp154-5), at its peak the British army in France had to feed 2,700,000 men: "To keep one division in the field for one day required 'nearly 200 tons dead weight of supplies', and Haig's army consisted of more than 60 divisions". Haig as chief executive comes out well; Haig as general, somewhat well, though I haven't been entirely shifted from the "lions led by donkeys" camp. You could argue that Haig's "one last push and we'll break though into open country" was indeed finally vindicated, but too many people died to get there. Then again, it's also hard to shake the thought that, with the technologies of the day, there was little alternative to an attritional strategy, however appalling the casualties became.

Military historian Allan Mallinson doesn't like the "lions led by donkeys" line (it's "facile"), but in his Too Important for the Generals: Losing and Winning the First World War he's not impressed by the generals' strategic grip: "nothing can acquit the high command of its failure to see beyond no-man's-land [on the Western Front] and its embrace of the 'strategy of attrition" (p330). He also believes that the politicians should have taken a stronger hold of the overall direction of the war, and in particular gone for more flanking initiatives (like a better run Dardanelles operation) as well as boosting support for Russia and Serbia, rather than letting Russia slide into revolution and Serbia lose to Austria. All of which reflects the still unsettled scholarship on the Great War: you no sooner read one book suggesting the generals were doing as well as they could than the next suggests the opposite.

In brief: anything Robert Harris turns his hand to (the life of Cicero; a dystopian world where Hitler won) is highly readable. You'll like Conclave, which (natch) is about a papal election. Carl Hiaasen's written a series of high-paced comic novels about Florida bizarrenesses: his latest, Razor Girl, is right up with the rest of them. And if you like private eye novels set back in the Roman Empire - and let's face it, who wouldn't - you've probably worked your way through Lindsey Davis' Falco and Flavia Albia series and John Maddox Roberts' SPQR series, but don't miss the equally good Russo ones by Ruth Downie. I've just finished the latest, the fifth in the series, Vita Brevis.

Tuesday, 29 November 2016

Quick - before the chance disappears

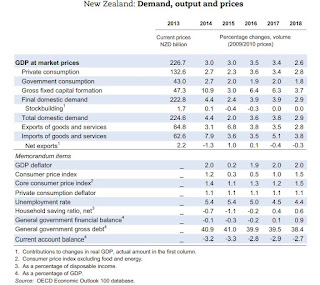

Yesterday the OECD updated its Global Economic Outlook: here's what it thinks will happen to the world at large...

A forecast is a forecast is a forecast, and who knows what will actually come to hand. But if anything like this reasonably educated guess fronts up, we're in for a couple of good years. Growth will be faster than the OECD average, inflation lower, unemployment well below the OECD's, and our fiscal books in much better shape. There are aspects of it that could be better - we don't have a great long-term future if unemployment is low mainly because we're all busy clearing up after the latest earthquake - but it would still be a pretty good outcome to bag.

What slightly disappoints me is that we may be missing an opportunity to make things even better. One of the OECD's recommendations in their country forecast for New Zealand is that, given that there is "considerable scope to improve infrastructure" - don't we know it - "Government planning should begin now to establish a pipeline of good quality projects, including to promote productivity-enhancing urban densification and to service the rapidly expanding housing stock".

I'd assumed that we already had the pipeline they're talking about - in fact, we are issuing progress reports (like this latest one) on a Thirty Year plan first published last year - so I'm not entirely sure what the OECD is on about. I hope there isn't a gap between what we've currently got in mind and what the OECD thinks we should be doing.

In any event, whatever we, or the OECD, have got in mind, we should have been getting on with it while the going was exceptionally good. There was the opportunity to finance infrastructure at all-time historically cheap interest rates: our 10 year government stock yield hit an all-time low of 2.12% in mid August, and there was a very good chance that we could also have got 20, 25 or 30 year bonds away at very sharp rates indeed while world markets were obsessed with the proverbial "hunt for yield".

We've missed the very best opportunity to fill our boots with exceptionally cheap financing and build useful productivity-enhancing stuff with it: our 10 year government bond yield has already risen to over 3% (3.07% currently), following the post-Trump rise in US Treasury yields. Even so, the rates are still attractive by historical standards. We should pull finger and get the hell on with it while the going is still pretty good.

...and here's its pick for what will happen to New Zealand.

A forecast is a forecast is a forecast, and who knows what will actually come to hand. But if anything like this reasonably educated guess fronts up, we're in for a couple of good years. Growth will be faster than the OECD average, inflation lower, unemployment well below the OECD's, and our fiscal books in much better shape. There are aspects of it that could be better - we don't have a great long-term future if unemployment is low mainly because we're all busy clearing up after the latest earthquake - but it would still be a pretty good outcome to bag.

What slightly disappoints me is that we may be missing an opportunity to make things even better. One of the OECD's recommendations in their country forecast for New Zealand is that, given that there is "considerable scope to improve infrastructure" - don't we know it - "Government planning should begin now to establish a pipeline of good quality projects, including to promote productivity-enhancing urban densification and to service the rapidly expanding housing stock".

I'd assumed that we already had the pipeline they're talking about - in fact, we are issuing progress reports (like this latest one) on a Thirty Year plan first published last year - so I'm not entirely sure what the OECD is on about. I hope there isn't a gap between what we've currently got in mind and what the OECD thinks we should be doing.

In any event, whatever we, or the OECD, have got in mind, we should have been getting on with it while the going was exceptionally good. There was the opportunity to finance infrastructure at all-time historically cheap interest rates: our 10 year government stock yield hit an all-time low of 2.12% in mid August, and there was a very good chance that we could also have got 20, 25 or 30 year bonds away at very sharp rates indeed while world markets were obsessed with the proverbial "hunt for yield".

We've missed the very best opportunity to fill our boots with exceptionally cheap financing and build useful productivity-enhancing stuff with it: our 10 year government bond yield has already risen to over 3% (3.07% currently), following the post-Trump rise in US Treasury yields. Even so, the rates are still attractive by historical standards. We should pull finger and get the hell on with it while the going is still pretty good.

Good ideas - but now what?

Yesterday's report from the Productivity Commission, 'Achieving New Zealand's Productivity Potential' (press release here, overview here, whole thing here), is full of good ideas.

In the housing market, for example, their proposals would have the happy outcome of pressing both the equity and efficiency buttons at once. In addition to dealing to people sleeping in cars, a better functioning market would lift productivity: "A housing market that responds to demand pressures facilitates labour mobility and improves productivity by allowing firms access to a deeper labour market, as well as more opportunities for specialisation, innovation and technology spillovers. For workers, being able to live in places where their skills are most valued improves their incomes" (p65).

The Commission is big enough and bad enough to push its own barrow, so I'm not going to recycle its full list of proposals, but I would like to add a little bit of support for its competition ideas.

As the report says, "Lifting competitive intensity is key to improving services sector performance...Increasing competition would energise market selection effects, making it less likely that productive resources – including skills and intellectual property – get trapped in lagging slow-growing incumbents and, instead, flow to innovative new entrants" (p69). And trapped they are: as the report overview notes (p7), "a relatively long and persistent tail of productivity underperformance exists in New Zealand", with not enough competitive pressure on it to either lift its game or get off the pitch.

The Commission has two suggestions, and I'm fully behind both of them (though I should disclose that I may be a teeny bit involved in helping to get the second one on the agenda).

The first one is reform of s36 of our Commerce Act. Life has moved on, particularly in Australia, since the Commission started running with this, so here's the Commission's latest take (p69):

Which is where MBIE could usefully do its bit to improve the labour productivity of the economy by letting us know what it's going to recommend on s36 and market studies. It's just over a year now since MBIE started down this path, and the final round of submissions and cross-submissions closed four months ago.

It's time to hear from you, guys.

In the housing market, for example, their proposals would have the happy outcome of pressing both the equity and efficiency buttons at once. In addition to dealing to people sleeping in cars, a better functioning market would lift productivity: "A housing market that responds to demand pressures facilitates labour mobility and improves productivity by allowing firms access to a deeper labour market, as well as more opportunities for specialisation, innovation and technology spillovers. For workers, being able to live in places where their skills are most valued improves their incomes" (p65).

The Commission is big enough and bad enough to push its own barrow, so I'm not going to recycle its full list of proposals, but I would like to add a little bit of support for its competition ideas.

As the report says, "Lifting competitive intensity is key to improving services sector performance...Increasing competition would energise market selection effects, making it less likely that productive resources – including skills and intellectual property – get trapped in lagging slow-growing incumbents and, instead, flow to innovative new entrants" (p69). And trapped they are: as the report overview notes (p7), "a relatively long and persistent tail of productivity underperformance exists in New Zealand", with not enough competitive pressure on it to either lift its game or get off the pitch.

The Commission has two suggestions, and I'm fully behind both of them (though I should disclose that I may be a teeny bit involved in helping to get the second one on the agenda).

The first one is reform of s36 of our Commerce Act. Life has moved on, particularly in Australia, since the Commission started running with this, so here's the Commission's latest take (p69):

In its inquiry into boosting services sector productivity, the Productivity Commission found that Section 36 of the Commerce Act – taking advantage of market power – is impractical and needs to be reviewed. Under this Act, abuse of dominance cases are assessed using a “purpose test” that the conduct had an anti-competitive purpose and a “counterfactual test” that the conduct could not have occurred in the absence of market power.

This approach is increasingly out of step internationally, with competition law in almost all other OECD countries focussing on whether a dominant firm’s behaviour creates demonstrable harm to consumers (OECD, 2005). Following the Harper Review on competition policy in Australia – which recommended shifting to an effects-based test of abuse of dominance – the New Zealand approach is looking increasingly unusual and unworkable.The second is proactive kicking the tyres ("market studies") where there might be competition problems (p70):

Much of the debate on competition in New Zealand has been from a legal perspective and very little is known about the economic impact of competition in New Zealand markets. Given signs of weak competition in conjunction with high rates of return in some parts of the economy, policy-relevant research aimed at better understanding the role of competition in the economy would be highly beneficial.

For example, the advocacy role of the Commerce Commission in promoting competition as means to enhanced economic efficiency and wellbeing could be improved. Specifically, the Commerce Commission should be able to conduct market studies without reference to a merger application or other investigation, as is the case in Australia. These changes would help strengthen the competition culture among policymakers and the public. For example, the ability to conduct market studies would allow the Commerce Commission to investigate potential barriers to competition in poorly performing but highly profitable industries.A policy combo aimed at effectively policing any Big Beasts impeding the competitive process, and at looking to see whether poor outcomes but high profits are down to a lack of effective competition, sounds like an excellent double header to me. And I'd stress that this is not from any anti-business perspective: as the Commission points out (pp67-8), it is other businesses that wear the input costs of whatever old Spanish practices may be operating in the cosier corners of the economy.

Which is where MBIE could usefully do its bit to improve the labour productivity of the economy by letting us know what it's going to recommend on s36 and market studies. It's just over a year now since MBIE started down this path, and the final round of submissions and cross-submissions closed four months ago.

It's time to hear from you, guys.

Thursday, 10 November 2016

Finally...

At last.

Last month, workers arrived and started to put advertising hoarding up...

...announcing that this former New World supermarket in Browns Bay...

...is going to be transformed into this (artist's image) very snazzy apartment block...

...of 56 apartments and 8 penthouses, with "impressive sea views" (and they will be) from level 2 up. A much needed boost to the housing supply and a much better use of prime land.

Finally.

And I say 'finally' because this is one of those Special Housing Areas where development was meant to be expedited, but where there has actually been a lag of over a year between designation as a Special Housing Area, in August 2015, and anything at all happening on the ground. The pretty pictures have been put up, and there's a sales office opened around the corner, but not a sod has yet been turned by way of actual construction.

And as I mentioned in previous posts (here, here and here) the delay in the supposedly fast-track site is all the odder, because non-Special-Housing-Area apartment blocks have been going up like billy-o in Browns Bay, including down the same street.

Now, I don't have any beef with the developers. It's their precious, and they can take their own good time to do whatever they want with it, and it looks like they're going to deliver something very nice indeed. And as we learned today (from pages 24-5 of the latest Monetary Policy Statement), there are severe capacity constraints in the Auckland building trade:

But it still leaves me with a nagging feeling that the interesting Special Housing Area initiative (faster planning approval in exchange for including some 'affordable' housing) didn't work out as everyone had imagined. We need to know whether this policy experiment worked, and if it did, repeat it or widen it, and if not, why.

Otherwise we'll continue to blunder around with well-intentioned housing ideas that never get properly evaluated - not a good enough approach to one of our most pressing national issues.

Last month, workers arrived and started to put advertising hoarding up...

...announcing that this former New World supermarket in Browns Bay...

...is going to be transformed into this (artist's image) very snazzy apartment block...

...of 56 apartments and 8 penthouses, with "impressive sea views" (and they will be) from level 2 up. A much needed boost to the housing supply and a much better use of prime land.

Finally.

And I say 'finally' because this is one of those Special Housing Areas where development was meant to be expedited, but where there has actually been a lag of over a year between designation as a Special Housing Area, in August 2015, and anything at all happening on the ground. The pretty pictures have been put up, and there's a sales office opened around the corner, but not a sod has yet been turned by way of actual construction.

And as I mentioned in previous posts (here, here and here) the delay in the supposedly fast-track site is all the odder, because non-Special-Housing-Area apartment blocks have been going up like billy-o in Browns Bay, including down the same street.

Now, I don't have any beef with the developers. It's their precious, and they can take their own good time to do whatever they want with it, and it looks like they're going to deliver something very nice indeed. And as we learned today (from pages 24-5 of the latest Monetary Policy Statement), there are severe capacity constraints in the Auckland building trade:

So maybe the developers couldn't have got it going any faster, even if they were dead keen to. And as I've said before, this is a sample of one, and maybe other Special Housing Areas have been bounding along faster than their non-SHA counterparts.The construction industry is reportedly facing several constraints that may impede future activity, such as access to labour, materials, and funding. Most contacts are struggling to find labour to fill a wide range of positions. The labour shortage is reportedly most acute in Auckland,where high living costs are deterring construction workers from relocating from Canterbury or immigrating from overseas.Contacts note that it is also becoming increasingly difficult to access construction materials, with shortages becoming acute for some materials. This is leading to some construction firms facing long wait-times and cost increases.There has recently been a tightening in credit availability in the construction industry, constraining some firms’ ability to increase activity.Contacts note that new and small firms, as well as apartment developers,have been impacted most severely

But it still leaves me with a nagging feeling that the interesting Special Housing Area initiative (faster planning approval in exchange for including some 'affordable' housing) didn't work out as everyone had imagined. We need to know whether this policy experiment worked, and if it did, repeat it or widen it, and if not, why.

Otherwise we'll continue to blunder around with well-intentioned housing ideas that never get properly evaluated - not a good enough approach to one of our most pressing national issues.

"My work here is done"...

All as expected from the Reserve Bank today, the OCR cut to 1.75% and expected to stay there "for a very long time", as its head of economics John McDermott put it. All going well, Governor Graeme Wheeler can put his feet up for the final year of his current contract: his work here is done. And the economic outlook, while still beset by significant uncertainties, is looking good by developed economy standards: GDP growth in the pipeline of around 3.5% a year or a tad more, and the unemployment rate dropping to 4.5%.

Some interesting graphs from the Monetary Policy Statement. First up, what's been happening to the domestic 'non-tradables' inflation we generate here in New Zealand (I'd had a look too when then the latest data came out).

It looks like it's bottomed out and is now rising. More importantly, here's where the RBNZ thinks it is headed.

So we'll have to start recalibrating our thinking about what to expect when those brown envelopes hit the letterbox.

And then there's this, which shows how the RBNZ thinks the OCR might need to move if different combos of possible scenarios were to play out. Not everyone likes these 'fan' charts, but they have their uses, and in this one you can see the indefinitely-low OCR as the Bank's best call right now, but you can also see the range of uncertainty around it, running from an OCR of 0.5% through to 2.75%.

But there can be less benign strategic responses to easing competitive pressure. These strategists are, I trust, planning to stay on the right side of s27 of our Commerce Act ("contracts, arrangement or understandings substantially lessening competition"), s30 (price fixing), and s47 ("A person must not acquire assets of a business or shares if the acquisition would have, or would be likely to have, the effect of substantially lessening competition in a market").

Some interesting graphs from the Monetary Policy Statement. First up, what's been happening to the domestic 'non-tradables' inflation we generate here in New Zealand (I'd had a look too when then the latest data came out).

It looks like it's bottomed out and is now rising. More importantly, here's where the RBNZ thinks it is headed.

So we'll have to start recalibrating our thinking about what to expect when those brown envelopes hit the letterbox.

And then there's this, which shows how the RBNZ thinks the OCR might need to move if different combos of possible scenarios were to play out. Not everyone likes these 'fan' charts, but they have their uses, and in this one you can see the indefinitely-low OCR as the Bank's best call right now, but you can also see the range of uncertainty around it, running from an OCR of 0.5% through to 2.75%.

And I put it up just to remind people that, even with models up the wazoo, forecasting is an inexact art (as a certain election yesterday vividly reminded us), and that we ought to be a bit more charitable about those faced with making tough calls in uncertain circumstances (as I've also argued here and, especially, here).

The post-Statement press conference had its interesting moments. We now know, for example, that the "neutral" level of the OCR is now estimated to be around 4% rather than the 4.5% that might have been appropriate in a world where inflation was higher (an estimate adroitly winkled out by the NBR's Rob Hosking, whose write-up of today's decision is here).

Only the anointed get invited to the press conference these days, but if I'd been admitted to the elect, I'd have liked to have asked about what the Bank meant when it found, in its latest soundings with businesses around the country (reported on p25 of the MPS), that

I'm pleased to hear about vigorous levels of competition, and not surprised businesses are looking for clever ways to cope. The smartest way would be to innovate yourself into a position where you can charge better prices for a better product.High levels of competition are compressing margins and firms are thinking strategically about how to ease this pressure.

But there can be less benign strategic responses to easing competitive pressure. These strategists are, I trust, planning to stay on the right side of s27 of our Commerce Act ("contracts, arrangement or understandings substantially lessening competition"), s30 (price fixing), and s47 ("A person must not acquire assets of a business or shares if the acquisition would have, or would be likely to have, the effect of substantially lessening competition in a market").

Wednesday, 9 November 2016

An unfortunate coincidence

Next year will see an unfortunate coincidence of timing. The five year term of Graeme Wheeler as governor of the Reserve Bank, and the associated Policy Target Agreement, will run out in September, which is likely to coincide with the height of the general election campaign: the vote must be held by November 18 at the latest.

It was a high probability in any event that our monetary policy arrangements would, yet again, be a political football. Opposition parties (as I've observed before, most recently here) have been wholly unable in recent elections to refrain from reflex oppositionism - "if the government is for inflation targeting, we're against it" - or from running after the alternative fad du jour.

The timing makes a rerun of this dispiriting opportunism a certainty: whether Graeme Wheeler stays or goes, a new contract for the RBNZ governor triggers (under s9(1) of the Reserve Bank Act) a new Policy Targets Agreement. The key bit of the existing one - "the policy target shall be to keep future CPI inflation outcomes between 1 per cent and 3 per cent on average over the medium term, with a focus on keeping future average inflation near the 2 per cent target midpoint" - will be up for grabs.

I wouldn't be surprised if the Act itself doesn't get a headbutting, too, especially s8 which says "The primary function of the Bank is to formulate and implement monetary policy directed to the economic objective of achieving and maintaining stability in the general level of prices". There are plenty of folks who'd like to revisit that, too, and lumber the Bank with other or additional objectives.

My own strong preference would be to leave the big ticket bits of the existing arrangements alone, as, for example, the Aussies did a few months ago when they signed up for more of the same under their new RBA governor, Philip Lowe. But you don't have to take my opinion (or the Aussies' decision) for it: it had slipped under my radar, and I only got alerted to it by a colleague in a conversation about something else, but in September the Bank of Canada (BoC) also announced that it was going to carry on with its current inflation targeting regime, and that it was going to stay with an inflation target of 2%, as the midpoint of a 1% to 3% range.

Why should we care about the Canadians?

Firstly, because the BoC was one of the earliest banks to go the inflation targeting route - second only to us, as it happens. We kicked off in late 1989 and they joined the line-out in February 1991. They're the major central bank with the longest experience in the inflation targetting game. So if they've decided the inflation targeting route is still the way to go (they've signed up for at least five more years of it), and that 1% to 3% with a focus on 2% is still sensible, then it rather suggests that we ought to keep on doing it, too.

And secondly, because the BoC actually spent quite a lot of time kicking the tyres of potential alternatives, and flagged them away. If you want the short version, this letter from the BoC governor to the Minister of Finance covers it (in the 'Related issues' bit): neither targeting nominal GDP, nor targetting a price level (rather than an inflation rate), which are the two leading alternatives in the frame at the moment, looked better than the current inflation targeting regime. If you want to look at the detailed research programme it's all here.

So I'm minded to say: let's free ride on the BoC's research, and do what they've done. As the BoC governor said in this speech

Not that I expect for a second that the weight of evidence is actually going to count a bean against the next round of silliness.

It was a high probability in any event that our monetary policy arrangements would, yet again, be a political football. Opposition parties (as I've observed before, most recently here) have been wholly unable in recent elections to refrain from reflex oppositionism - "if the government is for inflation targeting, we're against it" - or from running after the alternative fad du jour.

The timing makes a rerun of this dispiriting opportunism a certainty: whether Graeme Wheeler stays or goes, a new contract for the RBNZ governor triggers (under s9(1) of the Reserve Bank Act) a new Policy Targets Agreement. The key bit of the existing one - "the policy target shall be to keep future CPI inflation outcomes between 1 per cent and 3 per cent on average over the medium term, with a focus on keeping future average inflation near the 2 per cent target midpoint" - will be up for grabs.

I wouldn't be surprised if the Act itself doesn't get a headbutting, too, especially s8 which says "The primary function of the Bank is to formulate and implement monetary policy directed to the economic objective of achieving and maintaining stability in the general level of prices". There are plenty of folks who'd like to revisit that, too, and lumber the Bank with other or additional objectives.

My own strong preference would be to leave the big ticket bits of the existing arrangements alone, as, for example, the Aussies did a few months ago when they signed up for more of the same under their new RBA governor, Philip Lowe. But you don't have to take my opinion (or the Aussies' decision) for it: it had slipped under my radar, and I only got alerted to it by a colleague in a conversation about something else, but in September the Bank of Canada (BoC) also announced that it was going to carry on with its current inflation targeting regime, and that it was going to stay with an inflation target of 2%, as the midpoint of a 1% to 3% range.

Why should we care about the Canadians?

Firstly, because the BoC was one of the earliest banks to go the inflation targeting route - second only to us, as it happens. We kicked off in late 1989 and they joined the line-out in February 1991. They're the major central bank with the longest experience in the inflation targetting game. So if they've decided the inflation targeting route is still the way to go (they've signed up for at least five more years of it), and that 1% to 3% with a focus on 2% is still sensible, then it rather suggests that we ought to keep on doing it, too.

And secondly, because the BoC actually spent quite a lot of time kicking the tyres of potential alternatives, and flagged them away. If you want the short version, this letter from the BoC governor to the Minister of Finance covers it (in the 'Related issues' bit): neither targeting nominal GDP, nor targetting a price level (rather than an inflation rate), which are the two leading alternatives in the frame at the moment, looked better than the current inflation targeting regime. If you want to look at the detailed research programme it's all here.

So I'm minded to say: let's free ride on the BoC's research, and do what they've done. As the BoC governor said in this speech

renewing the inflation target is a cause for celebration...

We have studied the research and the theory behind frameworks such as price-level targeting and targeting the growth of nominal gross domestic product. But, to date, we have not seen convincing evidence that there is an approach that is better than our inflation targets...

The renewal of our inflation-targeting agreement is good news. Whether you remember the bad times or not, high, variable and unpredictable inflation is deadly for confidence. It is a source of uncertainty that would be brutal in today’s economic climate.

We will not let that happen. We have a record of more than 25 years as a successful inflation-targeting central bank. This has helped businesses and individuals make financial decisions with certainty and confidence. It has led to an environment that is conducive to sustained economic growth.

The renewal of the inflation-targeting agreement sets us up to extend this track record of success for another five years.We should, of course, keep questioning our own arrangements, as the Canadians just have, and with a genuine interest in improvement rather than as a cheap political stunt. But all the evidence is that what we, and they, and the Aussies, have got is still the best way to go.

Not that I expect for a second that the weight of evidence is actually going to count a bean against the next round of silliness.

Friday, 4 November 2016

How will the Aussies' new competition law play out?

And so to my final write-up of last week's RBB Economics conference in Sydney, the session on "How Australia's competition law deals with excessive pricing". It covered two topics, how competition law is going to evolve in the wake of the Aussies' changing their version of our s36 (the abuse of market power), and how the new "concerted practices" prohibition might operate.

Liza Carver, a partner at Herbert Smith Freehills, spoke on "Reform of section 46: what does it mean for unilateral pricing decisions?" and looked at potential implications in three areas. Predatory pricing: the new law is no clearer than the old on how you go about applying a "below average variable cost" standard, and might (no stronger) have opened up the possibility that recoupment isn't a necessary element anymore, because the basis for recoupment might have been grounded in the now junked "take advantage" wording of the old version of the law. Margin squeezes: the new law isn't any clearer on this tricky area, either, with Liza saying that the courts hadn't been able to deal with them very comfortably (she instanced our own beloved Telecom v Clear), which is why there have been more industry specific regulators and more access price regulation. Excessive pricing: she worried that "it will be open for the ACCC and potential plaintiffs to allege that "excessive" pricing by a firm with a substantial degree of market power has or is likely to have the effect of substantially lessening competition in a downstream market".

If Liza's right on that last point, that's probably a bit more radical an outcome than proponents of change to Australia's s46 would have meant: merely being a monopoly, and charging the monopolist's price, weren't (in my mind anyway) ever what the Harper changes were aimed at. I had a quick squizz at how the ACCC is minded to operate under the new misuse of market power legislation (assuming it gets through the Aussie political process, something I haven't been able to get a feel for), but the draft guidelines didn't look as if the ACCC threatens to gallop off in new radical directions. They don't mention excessive pricing per se at all, other than in the context of a margin squeeze.

Wayne Leach, a partner at King and Wood Mallesons, spoke on "Will the new concerted practices law in Australia help to bring down prices?". Since we don't have anything along these lines here at home, by way of background this is the proposed legislation:

And positively the last, final word (at least for a while) on misuse of market power: last night LEANZ had a well-attended debate in Auckland pitting the suave and empathetic duo of Russell McVeagh's Sarah Keane and NERA's James Mellsop (supporting the case we should leave s36 alone) against the polished and measured team of Matthews Law's Andy Matthews and me (supporting the case we should do a Harper). There wasn't a vote at the end, and modesty prevents me from speculating on what it would have indicated had there been.

That was the last LEANZ event for this year: don't forget to pay your sub to support next year's programme. Special thanks to Richard Meade, who herded all the cats into position, and to Mayne Wetherell who very kindly hosted the event at their modern new office in the Viaduct and who helped circumvent Google Maps' unhelpful misdirection to a nearby building site.

Liza Carver, a partner at Herbert Smith Freehills, spoke on "Reform of section 46: what does it mean for unilateral pricing decisions?" and looked at potential implications in three areas. Predatory pricing: the new law is no clearer than the old on how you go about applying a "below average variable cost" standard, and might (no stronger) have opened up the possibility that recoupment isn't a necessary element anymore, because the basis for recoupment might have been grounded in the now junked "take advantage" wording of the old version of the law. Margin squeezes: the new law isn't any clearer on this tricky area, either, with Liza saying that the courts hadn't been able to deal with them very comfortably (she instanced our own beloved Telecom v Clear), which is why there have been more industry specific regulators and more access price regulation. Excessive pricing: she worried that "it will be open for the ACCC and potential plaintiffs to allege that "excessive" pricing by a firm with a substantial degree of market power has or is likely to have the effect of substantially lessening competition in a downstream market".

If Liza's right on that last point, that's probably a bit more radical an outcome than proponents of change to Australia's s46 would have meant: merely being a monopoly, and charging the monopolist's price, weren't (in my mind anyway) ever what the Harper changes were aimed at. I had a quick squizz at how the ACCC is minded to operate under the new misuse of market power legislation (assuming it gets through the Aussie political process, something I haven't been able to get a feel for), but the draft guidelines didn't look as if the ACCC threatens to gallop off in new radical directions. They don't mention excessive pricing per se at all, other than in the context of a margin squeeze.

Wayne Leach, a partner at King and Wood Mallesons, spoke on "Will the new concerted practices law in Australia help to bring down prices?". Since we don't have anything along these lines here at home, by way of background this is the proposed legislation:

And here's the definition of concerted practices from the ACCC's draft guidelines on how they'll apply the law:Section 45

A concerted practice is a form of coordination between competing businesses by which, without them having entered a contract, arrangement or understanding, practical cooperation between them is substituted for the risks of competitionThe lawyers amongst us will recognise that "contract, arrangement or understanding" bit: it's also the language in our s27. So the intent (as Wayne said) is to catch things that don't quite make the "understanding" threshold in the existing law, but are still coordinated in some way and have an competition-lessening effect. The ACCC gave a number of hypothetical examples: one was

A number of petrol retailers notify each other of their future pricing intentions. While they have not committed to do so, they begin to regularly follow the price change foreshadowed by others. Retailers find such information assists them and start making business decisions in expectation of calls from their competitor. No attempt is made to reject the calls. Such disclosures results in the pricing uncertainties present in a competitive market effectively being substituted for cooperationIt's all new territory. Wayne felt that the Aussie law, with the requirement that the challenged concerted practice must be shown (with proper evidence, for example on prices) to have had an actual effect on competition in the market, should help avoid the overreach of the European courts, where anti-competitive effect has effectively been presumed rather than proved. And he reckoned that, as part of establishing whether the practice did actually have an impact, the US approach of "plus factors" might come into play. "Plus factors" include things like "outcomes that can be explained rationally only as a result of concerted action". We'll see how it plays out: if you're interested, I expect Wayne's written-up analysis will turn up in due course on his firm's In Competition blog.

And positively the last, final word (at least for a while) on misuse of market power: last night LEANZ had a well-attended debate in Auckland pitting the suave and empathetic duo of Russell McVeagh's Sarah Keane and NERA's James Mellsop (supporting the case we should leave s36 alone) against the polished and measured team of Matthews Law's Andy Matthews and me (supporting the case we should do a Harper). There wasn't a vote at the end, and modesty prevents me from speculating on what it would have indicated had there been.

That was the last LEANZ event for this year: don't forget to pay your sub to support next year's programme. Special thanks to Richard Meade, who herded all the cats into position, and to Mayne Wetherell who very kindly hosted the event at their modern new office in the Viaduct and who helped circumvent Google Maps' unhelpful misdirection to a nearby building site.

Rumours of my conversion have been greatly exaggerated

I got some funny comments at last night's LEANZ section 36 debate, along the lines that I'd suddenly gone weird and soft about competition law enforcement.

Eh?

Moi?

Haven't I been banging on about more effective legislation to patrol abuse of market power? About how competition authorities may be getting too lenient on mergers? On throwing the book at criminal hard core cartels?

Puhleez!

I tracked down where people had got the idea from. This:

So you can see why people would look at this and think at first glance that the headline represented my view.

It doesn't. Never has. Never will.

The headline is actually the headline from a recent post, 'Is no competition policy the best competition policy?', on Paul Walker's Anti-Dismal blog. The headline is his. I'm only in the first paragraph because Paul started his piece with a reference to a post I did about getting the best out of competition agency economists, and went on from there with his own views about the desirability or otherwise (mainly otherwise) of competition law.

As for Paul's arguments? Nah (mostly). The odd point has some validity - yes, overzealous competition enforcement could interfere with the very competition it's meant to promote, which is (for example) one of the reasons people point to the potential "chilling effects" of the likes of section 36 of our Commerce Act on big companies' willingness to be tough competitors.

But for the most part it's off beam. You don't want mergers leading to very large firms wielding monopoly power (giving less, charging more). You don't want cartels forming, persisting, or going unpunished when rumbled: they're a rort and a distortion, and in the worst cases akin to fraud. You don't want the competitive auction process sidelined by bid rigging. You don't want companies carving up markets into exclusive sales territories. You don't want big companies foreclosing the opportunity for new entrants to compete. And to make all that happen, you need effective competition law and enforcement. No hanging judges, no slaps with a wet bus ticket, but good middle of the road rules, effectively monitored.

Right. That clear enough for everyone? Jolly good.

Carry on.

Eh?

Moi?

Haven't I been banging on about more effective legislation to patrol abuse of market power? About how competition authorities may be getting too lenient on mergers? On throwing the book at criminal hard core cartels?

Puhleez!

I tracked down where people had got the idea from. This:

So you can see why people would look at this and think at first glance that the headline represented my view.

It doesn't. Never has. Never will.

The headline is actually the headline from a recent post, 'Is no competition policy the best competition policy?', on Paul Walker's Anti-Dismal blog. The headline is his. I'm only in the first paragraph because Paul started his piece with a reference to a post I did about getting the best out of competition agency economists, and went on from there with his own views about the desirability or otherwise (mainly otherwise) of competition law.

As for Paul's arguments? Nah (mostly). The odd point has some validity - yes, overzealous competition enforcement could interfere with the very competition it's meant to promote, which is (for example) one of the reasons people point to the potential "chilling effects" of the likes of section 36 of our Commerce Act on big companies' willingness to be tough competitors.

But for the most part it's off beam. You don't want mergers leading to very large firms wielding monopoly power (giving less, charging more). You don't want cartels forming, persisting, or going unpunished when rumbled: they're a rort and a distortion, and in the worst cases akin to fraud. You don't want the competitive auction process sidelined by bid rigging. You don't want companies carving up markets into exclusive sales territories. You don't want big companies foreclosing the opportunity for new entrants to compete. And to make all that happen, you need effective competition law and enforcement. No hanging judges, no slaps with a wet bus ticket, but good middle of the road rules, effectively monitored.

Right. That clear enough for everyone? Jolly good.

Carry on.

Wednesday, 2 November 2016

The state of play in mergers

I've finally got round to wrapping up another of the sessions at last week's RBB Economics conference in Sydney - "Issues in merger control". Three down, one to go (the session on the outlook for Aussie competition law after the Harper review changes).

Carolyn Oddie, a partner at Allens, led off with "Recent developments in merger decisions". She had three issues. One was (she argued) a tendency for the ACCC to define over-narrow or over-segmented markets: one example (in a media merger) was "readers from an older demographic with a preference for newspapers". Another was whether the ACCC was getting the balance right when it looked at the influence of non-controlling minority shareholders, which has cropped up a fair bit (she instanced three decisions in the past year). She didn't conclude that the ACCC was necessarily wrong in how it approached them - it wasn't been overly blasé or overly alarmist about risks to competition - but rather that the whole topic needed a good shakedown, especially as jurisdictions overseas appeared to be going in different directions. The EC is increasingly relaxed about minority stakes, whereas the US is increasingly concerned: one issue in the States that has got a bit of attention recently is whether fund managers, each with (say) small stakes across a range of airlines, have a collective interest in, and influence on, their companies competing less hard against each other.

And her final issue - which was something of a recurrent theme throughout the conference - is how the ACCC handles dynamic industries with fast-moving technical change. Her conclusion was that the ACCC's media merger guidelines attribute a "very high bar before new technology will be considered a legitimate [competitive] constraint", that the approach is "arguably too conservative in modern industries", and that businesses are effectively forced to decline, after new technology hits, before any consolidation response is allowed the green light. I can imagine there's vigorous debate on exactly these same issues inside our Commerce Commission at the moment, given that it's got both NZME / Fairfax and Vodafone / Sky TV on its plate.

Next up was Simon Muys, a partner at Gilbert + Tobin, with "Comments on the ACCC's draft media merger guidelines" (you can find the guidelines themselves here). And again we're in the "new era economy" that China's regulator spoke about in his keynote address. Muys felt that the media merger guidelines were an opportunity missed to come to terms with this new world: even the term "media" may be obsolescing. He pointed out that if you looked back at some of the decisions - such as the mergers of bricks and mortar video shops (Video Ezy / Blockbuster in 2007) or linear TV broadcasters (Foxtel / Austar in 2012) - they now look distinctly archaic things to be worried about, given the way internet-distributed services like subscription video on demand have boomed since.

He said that a better way forward would have been to be more elastic about the idea of "media"; to accept the reality of monopolistic competition; to look on network effects as more likely to be positive for consumers rather than inherently negative; to focus on innovation and dynamic efficiency rather than on the traditional static 'SNIP' test for increased prices in the short-run; to realise that substitutability isn't the binary thing it might once have been, given that consumers do things like "multihome"; and to be more ready to accept inter-platform competition rather than inter-company competition as an acceptable outcome. All of which, he said, should lead to the policy conclusion that a competition agency ought to err on the side of non-intervention, and might even have a positive duty not to. If it did, it should focus on any risks of foreclosure - an apt comment, as just a few days later our Commerce Commission issued its 'Letter of Unresolved Issues' with the Vodafone / Sky merger, with foreclosure being one of them (see para 39 of the letter, for example).

And then we had Simon Bishop, one of the founding partners of RBB Economics, on "Economics and the Courts: constraining the discretion of competition authorities", which was about merger developments in the European Union. He was not impressed with how things have been going at the European Commission: his view was that it was now being overanxious about mergers it should be letting through, and that 4-to-3 mergers, for example, were now being challenged where previously they would have found it easier to get the nod.

He picked out two reasons why (in his view) they have been going awry. One was an over-mechanical reliance on Cournot or Nash / Bertrand modelling, which by inherent design will always spit out the conclusion that mergers lead to higher prices, and - again one of the recurrent themes of the conference - agencies ought to look more at the facts of how firms actually compete, especially dynamically, rather than trying to shoehorn them into assumed patterns of behaviour. The other thing that's gone off the rails, he felt, is progressively poorer internal quality assurance. The EC brought in a chief economist office to provide greater internal peer security after court reversals in the early 2000s, but Bishop argued that it wasn't operating properly anymore, had got too close to the core investigation teams, and was essentially reduced to "marking its own homework". Hence the otherwise rather mysterious title of his presentation: the EC's own internal scrutiny processes have been falling down, and the courts are having to step in as the watchdog.

Another excellent session. It's certainly not getting any easier for merger clearance authorities: they don't want to be hung up on yesterday's problems, which may be overturned tomorrow by the next technological advance, but they don't want to be suckers for any old argument about supposedly transformative new entry that magicks away competition issues, either. And even if they do sign up for "tech has changed things" to some greater or lesser degree, that can create new conundrums of its own. For example, if an agency does buy into the "new era" view, it's likely to look harder at incumbents buying out innovative start-ups. But if it does (as one commenter said from the floor) it could reduce the incentives for start-ups in the first place, as often their intended endgame is to sell themselves to the Googles or the Facebooks.

No easy answers to any of this, then, though one implication did come through loud and clear - all of us in the competition game (economists, lawyers, regulators) need to build some stronger standing capacity to read the direction of modern technologies.

Carolyn Oddie, a partner at Allens, led off with "Recent developments in merger decisions". She had three issues. One was (she argued) a tendency for the ACCC to define over-narrow or over-segmented markets: one example (in a media merger) was "readers from an older demographic with a preference for newspapers". Another was whether the ACCC was getting the balance right when it looked at the influence of non-controlling minority shareholders, which has cropped up a fair bit (she instanced three decisions in the past year). She didn't conclude that the ACCC was necessarily wrong in how it approached them - it wasn't been overly blasé or overly alarmist about risks to competition - but rather that the whole topic needed a good shakedown, especially as jurisdictions overseas appeared to be going in different directions. The EC is increasingly relaxed about minority stakes, whereas the US is increasingly concerned: one issue in the States that has got a bit of attention recently is whether fund managers, each with (say) small stakes across a range of airlines, have a collective interest in, and influence on, their companies competing less hard against each other.

And her final issue - which was something of a recurrent theme throughout the conference - is how the ACCC handles dynamic industries with fast-moving technical change. Her conclusion was that the ACCC's media merger guidelines attribute a "very high bar before new technology will be considered a legitimate [competitive] constraint", that the approach is "arguably too conservative in modern industries", and that businesses are effectively forced to decline, after new technology hits, before any consolidation response is allowed the green light. I can imagine there's vigorous debate on exactly these same issues inside our Commerce Commission at the moment, given that it's got both NZME / Fairfax and Vodafone / Sky TV on its plate.

Next up was Simon Muys, a partner at Gilbert + Tobin, with "Comments on the ACCC's draft media merger guidelines" (you can find the guidelines themselves here). And again we're in the "new era economy" that China's regulator spoke about in his keynote address. Muys felt that the media merger guidelines were an opportunity missed to come to terms with this new world: even the term "media" may be obsolescing. He pointed out that if you looked back at some of the decisions - such as the mergers of bricks and mortar video shops (Video Ezy / Blockbuster in 2007) or linear TV broadcasters (Foxtel / Austar in 2012) - they now look distinctly archaic things to be worried about, given the way internet-distributed services like subscription video on demand have boomed since.

He said that a better way forward would have been to be more elastic about the idea of "media"; to accept the reality of monopolistic competition; to look on network effects as more likely to be positive for consumers rather than inherently negative; to focus on innovation and dynamic efficiency rather than on the traditional static 'SNIP' test for increased prices in the short-run; to realise that substitutability isn't the binary thing it might once have been, given that consumers do things like "multihome"; and to be more ready to accept inter-platform competition rather than inter-company competition as an acceptable outcome. All of which, he said, should lead to the policy conclusion that a competition agency ought to err on the side of non-intervention, and might even have a positive duty not to. If it did, it should focus on any risks of foreclosure - an apt comment, as just a few days later our Commerce Commission issued its 'Letter of Unresolved Issues' with the Vodafone / Sky merger, with foreclosure being one of them (see para 39 of the letter, for example).

And then we had Simon Bishop, one of the founding partners of RBB Economics, on "Economics and the Courts: constraining the discretion of competition authorities", which was about merger developments in the European Union. He was not impressed with how things have been going at the European Commission: his view was that it was now being overanxious about mergers it should be letting through, and that 4-to-3 mergers, for example, were now being challenged where previously they would have found it easier to get the nod.

He picked out two reasons why (in his view) they have been going awry. One was an over-mechanical reliance on Cournot or Nash / Bertrand modelling, which by inherent design will always spit out the conclusion that mergers lead to higher prices, and - again one of the recurrent themes of the conference - agencies ought to look more at the facts of how firms actually compete, especially dynamically, rather than trying to shoehorn them into assumed patterns of behaviour. The other thing that's gone off the rails, he felt, is progressively poorer internal quality assurance. The EC brought in a chief economist office to provide greater internal peer security after court reversals in the early 2000s, but Bishop argued that it wasn't operating properly anymore, had got too close to the core investigation teams, and was essentially reduced to "marking its own homework". Hence the otherwise rather mysterious title of his presentation: the EC's own internal scrutiny processes have been falling down, and the courts are having to step in as the watchdog.

Another excellent session. It's certainly not getting any easier for merger clearance authorities: they don't want to be hung up on yesterday's problems, which may be overturned tomorrow by the next technological advance, but they don't want to be suckers for any old argument about supposedly transformative new entry that magicks away competition issues, either. And even if they do sign up for "tech has changed things" to some greater or lesser degree, that can create new conundrums of its own. For example, if an agency does buy into the "new era" view, it's likely to look harder at incumbents buying out innovative start-ups. But if it does (as one commenter said from the floor) it could reduce the incentives for start-ups in the first place, as often their intended endgame is to sell themselves to the Googles or the Facebooks.

No easy answers to any of this, then, though one implication did come through loud and clear - all of us in the competition game (economists, lawyers, regulators) need to build some stronger standing capacity to read the direction of modern technologies.

Tuesday, 1 November 2016

Getting the most out of economists

We had a session at last week's RBB Economics conference in Sydney on "How can a Chief Economist's team enhance competition law enforcement? - an examination of different approaches", with a panel made up of people who should know: Lilla Csorgo, chief economist on the competition side of our Commerce Commission; Graeme Woodbridge, chief economist for the whole caboodle at the ACCC; and RBB partner Derek Rydiard to talk about the European Commission's experience.

One conclusion that emerged was that competition authorities had experimented over the years with various internal structures, ranging from a separate 'consultancy on call', through the EC's model of an internal quality check unit, through to integration in (or at least close involvement with) the investigation teams. Of the various models, integration with the investigation teams, or, at a minimum, close and early involvement with the cases at hand, seemed to be working best.

That didn't surprise me: much the same evolution has been happening in the private sector. Groups of economists, lurking away from the main business of the company in some side-alley of corporate HQ, used (amazingly, in retrospect) to be quite common in the banking world, for example, but got shook out in the 80s and 90s, and rightly so. Employers understandably wanted to know exactly what value-add the economists were bringing to the party. I remember one exercise where I had to go round the various operating 'line' divisions and get them to contribute their share of the economics budget (which they did, by the way): it was quite a good mechanism to try and unearth the end users' need for, and satisfaction with, economics input.

Getting early involvement in the matters at hand is critical. There are few episodes more dispiriting, and inefficient, than an investigating team getting a long way down the track, only to have an economist helicoptered in, late in the piece, with an alternative theory of the case that might necessitate junking much of the work to date. It's not always the economist that's the problem: legal counsel can come late to projects as well and be equally disruptive. Either way, an integrated multi-disciplinary team day one is a better way to go.

It's also professionally better for the economists themselves: most want to make a contribution and help come to a decision, and don't want to be sidelined waiting for the phone to ring. Graeme Woodbridge said that one quality he especially looks for is the ability to get off the fence and make the call, and if you're going to be effective in a competition authority (or anywhere else), you should have that roll-up-your-sleeves-and-give-your-best-take mindset .

One thing that became apparent was that, when you look at the work the economists actually do, econometrics is on the outer, for a variety of reasons, including the uphill struggle to get results through the legal process that have margins of error around them (as I described here). There is some quantitative analysis going on - I gathered from Simon Bishop's presentation that the EC is still doing (and may be overfond of) merger modelling - but it's deterministic. The assumptions you make drive the results that come out. Stochastic analysis of real world data doesn't happen, or happen much.

I may have got a bit obstreperous at this point. It dawned on me that, these days, economically literate governments wouldn't dream of taking big economic policy decisions without some numerate analysis of the likely effects. Could you imagine, for example, a government deciding to whack up the minimum wage, or bring in an emissions trading scheme, or do pretty much anything of economic significance, without taking account of the empirical work on its potential effects? Well, yes, I know you can, if you're thinking about dumb-ass governments, but in most civilised places we're all into evidence-based policies, as we should be.