The Reserve Bank came out with a new discussion paper last week, 'Inflation expectations and low inflation in New Zealand'. While Discussion Papers are "mainly for academic and professional economists" - and, I should add, represent the staffers' views and not the Reserve Bank's - this one is relatively easy going, and worth a look, because the authors (Özer Karagedikli and Dr John McDermott) have had a go at investigating one of the major puzzles in modern macroeconomics: why inflation has stayed unusually low.

There are other biggies - why has productivity growth (assuming we've measured it right) slowed down and what if anything can we do about it, and what can (or should) policymakers do if they run out of fiscal space and/or hit the zero lower bound for interest rates - but the unexpectedly low inflation puzzle is front and centre across the developed world.

I'd love to say they nailed it, but once I'd got my head around what they'd done, I wasn't totally convinced.

The heart of their argument runs like this. Inflation expectations affect actual inflation: if (for example) people expect low inflation, they'll settle for low wage rises, which will feed into low actual inflation. Fair enough. And then they say: what if inflation expectations don't just arrive out of the blue but are (partially or largely) influenced by actual inflation? Suppose actual inflation is, unexpectedly, only 1.5% instead of 2.0%. People revise their expectations down in line with the lower actual rate, and their lowered expectations (and the price and wage behaviours that follow) drive actual inflation lower again, to say 1.0%. Expectations are revised again ... you get the idea. Voilà - a self-fulfilling circle driving inflation down (or up, if the initial surprise had been higher than expected actual inflation) and one that has nothing to do with the strength of the economy or other things you might have expected to dominate what happened to inflation.

So they built a nice little model, which worked just as they argue. If you'd like to go through the details I've got a summary below, though you'll find the paper accessible enough in its own terms if you'd prefer to go to the source.

It is an interesting paper. But I was left with several questions at the end of the exercise.

The first is around how they model expectations. They say, people's expected rate of inflation will be some blend of (a) the latest actual outcome over some recent period, a backward looking measure, and (b) the expected inflation rate as measured in a survey, a forward looking measure. And they find that, modelled this way, not only do expectations have a strong influence on actual inflation but the weight that people apparently place on the latest actual inflation rate has increased markedly since 2008-09. So you have an explanation for the persistence of low inflation: a self-validating and strengthening feedback loop from low inflation to even lower expectations to even lower inflation again.

But this is all rather odd. The survey that asks about people's expected inflation rate is their inflation expectation, by definition. Subsequently saying that expectations are actually a mixture of those expectations and actual inflation is a bit of logical gymnastics I can't quite follow. But, as they say, "The empirical treatment of inflation expectations is crucial for the purpose of this paper", and if you're not convinced by their formula (and I'm not), some of the results fall over.

Even if you go along with their approach, though, you're still left with other questions.

One is: why? Why did people change in recent years from putting more weight on what they expect to happen, to putting more weight on what's actually happened? Have they suddenly stopped believing that they can get a handle on what lies around the corner - which wouldn't surprise me, in a post-GFC, post Brexit world? The researchers may well have unearthed an interesting mechanism or process, but we're still left with an unsolved, if different, problem.

Another question is: in the world they've modelled, what's happened to central bank credibility? If everybody believed their local central bank would indeed keep inflation around 2% (or wherever), then their expectations would stay around 2% irrespective of any wobbles in actual inflation along the way. Perhaps people in New Zealand (and the eurozone, and Japan) have indeed thrown in the towel and now prefer to believe the evidence of their own lying eyes rather than subscribe to what central bank governors say. If true, that's important, but again it raises a whole new research agenda to unpick the next layer of answers.

Bottom line? Because of the somewhat idiosyncratic modelling of expectations in this research, I wouldn't get too hung up on its exact outcomes. But I think it does make a good, wider point. Expectations have always mattered: that's seen most obviously in hyperinflations and deflations. But clearly they matter in more normal times, too, and they may not have got the policy attention from central banks that they should have.

That's changing. In the US, the Fed has been paying more attention to the financial markets' view on five year forward inflation, for example, and recent Monetary Policy Statements from the RBNZ have been zeroing in on expectations, too: they've included an 'inflation expectations curve'. So far so good: the big issue, though, is having realised that expectations matter, and possibly matter a lot, do central banks know how to manage expectations back towards levels more consistent with the banks' inflation targets?

Monday, 27 June 2016

Wednesday, 22 June 2016

Competition is good for you, part 294

My post on how competition has been improving productivity and lowering prices in both Australia (retailing in general) and New Zealand (electricity) didn't go down well with everyone. One commenter on Twitter said that it was all very well for companies to try to become more efficient to cope with increased competition, but "In their desperation for competitiveness, where do the retailers push employee wages? Down. Migrants & casualisation".

As it happens, there hasn't been a lot of research on the distributional effects of greater competition: a big survey last year done by European Commission staff, 'Ex-post economic evaluation of competition policy enforcement: A review of the literature' found (p29) that

You can see that there are more jobs, and higher wages, for rich and poor alike, but poorer households' consumer spending goes up a good deal more than rich households' (because poorer households of necessity save less). And the rich unambiguously lose through the reduced profitability of the companies they, as the shareholding class, own.

I wouldn't necessarily go mad about this: these are early days for this kind of research, and the type of DSGE model used, while the bee's knees in modern modelling circles, can be a finicky hothouse contraption. But the results are exactly what you'd have expected: rolling back anti-competitive market power is good for consumers, and for poorer consumers more than richer. I'd draw an analogy with the producer market power created by protectionism: the poorer are disproportionately affected by the higher prices of the things that are typically 'protected' most (food, clothes, shoes). And it stands to reason that the poorer will be worst hit by any anti-consumer development: they had the least choice to begin with, whereas the rich have more options.

In any event we should know a bit more in the near future: this work was part of a conference the World Bank ran last year on 'Promoting Effective Competition Policies for Shared Prosperity and Inclusive Growth', and there's apparently a conference volume on its way.

Finally a hat-tip to the Vox website, the policy portal of the Centre for Economic Policy Research, which published these results. It's a terrific compendium of timely, wide-ranging, practical research, with something to say (in readable, short format) on all the important issues of the day. Highly recommended.

As it happens, there hasn't been a lot of research on the distributional effects of greater competition: a big survey last year done by European Commission staff, 'Ex-post economic evaluation of competition policy enforcement: A review of the literature' found (p29) that

But as luck would have it, along comes some new research, 'Competition policy and inclusive growth', which has had a crack at looking at the distributional impact of increasing competition (through the various effects of the European Union's policies against anti-competitive mergers and cartels). Their bottom line is that "Interventions have important redistributive effects that benefit the poorest in society", and here are some of the key numbers. The model captures the eventual economy-wide effect of a 'mark-up' shock (a setback to producers' profit margins from competition enforcement) on different groups in society.When a lack of competition raises prices and reduces the quality of products, it causes damages to all consumers, including the poorest people. In this context, it could be interesting to analyse the distributional effects of market power. Existing evidence seems to suggest that an increase in competition is particularly beneficial for low-income people. However, the literature in this area remains in its infancy and there are a number of topics deserving further research.

You can see that there are more jobs, and higher wages, for rich and poor alike, but poorer households' consumer spending goes up a good deal more than rich households' (because poorer households of necessity save less). And the rich unambiguously lose through the reduced profitability of the companies they, as the shareholding class, own.

I wouldn't necessarily go mad about this: these are early days for this kind of research, and the type of DSGE model used, while the bee's knees in modern modelling circles, can be a finicky hothouse contraption. But the results are exactly what you'd have expected: rolling back anti-competitive market power is good for consumers, and for poorer consumers more than richer. I'd draw an analogy with the producer market power created by protectionism: the poorer are disproportionately affected by the higher prices of the things that are typically 'protected' most (food, clothes, shoes). And it stands to reason that the poorer will be worst hit by any anti-consumer development: they had the least choice to begin with, whereas the rich have more options.

In any event we should know a bit more in the near future: this work was part of a conference the World Bank ran last year on 'Promoting Effective Competition Policies for Shared Prosperity and Inclusive Growth', and there's apparently a conference volume on its way.

Finally a hat-tip to the Vox website, the policy portal of the Centre for Economic Policy Research, which published these results. It's a terrific compendium of timely, wide-ranging, practical research, with something to say (in readable, short format) on all the important issues of the day. Highly recommended.

Friday, 17 June 2016

Competition is good for you, part 293

The Reserve Bank of Australia came out with its latest Quarterly Bulletin the other day, and in it there was a fascinating article, "Why Has Retail Inflation Been So Low?".

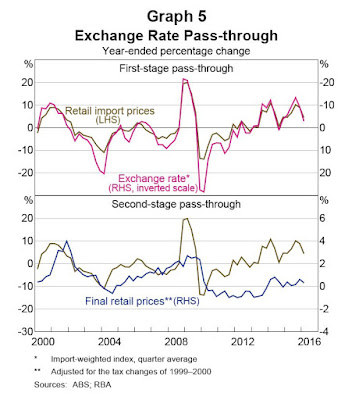

The authors wanted to find out why inflation in the Aussie shops was running lower than would have been expected, given the level of the Aussie dollar, as can be seen in the graph below, where the dark blue line (inflation) has been lagging below the pinky-purply one (the changing value of the A$).

And when they looked at it more closely they discovered an interesting thing. They disentangled what happens when exchange rates change. There are two steps: the first is the impact on the landed Aussie cost of imports (which goes up when the A$ falls and down when it rises), and the second stage is what happens to that changed landed cost of imports as it works its way through the wholesale and retail domestic distribution chain.

What they found was that the first stage hadn't changed at all: a lower A$, for example, was still feeding through to higher landed A$ costs of imports, just as it always did. But the second stage had changed quite a lot: from about 2010 onwards, there was less pass-through of those higher import costs into final consumer prices, as the graph below shows.

They weren't able to nail what had changed in the second stage using econometric methods, other than to confirm that statistical tests did indeed confirm a change in behaviour, so they had a qualitative fossick instead, based on what the RBA had been picking up from its regular programme of going round and talking to businesses ('liaison' in central bank geekspeak).

Increased competition appears to have been the reason (my emphasis added):

What a nice textbook outcome from increased competitive pressures: consumers have got a better deal, and producers have been pushed to improve their productivity. And it comes in a week where the latest instalment of MBIE's electricity price monitoring showed that retail electricity prices had dropped for the first time in 15 years, which MBIE said "was driven by increased discounting activity and incentive credits" - greater competition, in other words. Carl Hansen, the CEO at the Electricity Authority, said that the price fall "is one of the many indicators of strong competition in [the] residential electricity market. Another indicator is that smaller retailers have now grown their market share to 10 per cent which is putting significant pressure on the larger retailers".

It may be making a meal of the obvious, that competition is pro-consumer and pro-productivity, but the message doesn't always get through in New Zealand, or elsewhere. The lobbyists for the quiet life in sectors such as education, health and the professions are good at running the pro-producer line, and (like in bunfights over trade protectionism) the voice of the consumer doesn't get the hearing it should.

We need more competition across more markets, and you don't have to take just my word for it. The OECD, in the chapter on New Zealand in the latest update of its Economic Outlook, said that "Reducing barriers to FDI [foreign direct investment] and to competition in the electricity, transport and telecoms sectors would facilitate greater investment and innovation, increasing productivity and reducing prices". There's work to do if we're going to have the retail price and producer productivity benefits Australia is enjoying, and more of our utility bills going down.

The authors wanted to find out why inflation in the Aussie shops was running lower than would have been expected, given the level of the Aussie dollar, as can be seen in the graph below, where the dark blue line (inflation) has been lagging below the pinky-purply one (the changing value of the A$).

And when they looked at it more closely they discovered an interesting thing. They disentangled what happens when exchange rates change. There are two steps: the first is the impact on the landed Aussie cost of imports (which goes up when the A$ falls and down when it rises), and the second stage is what happens to that changed landed cost of imports as it works its way through the wholesale and retail domestic distribution chain.

What they found was that the first stage hadn't changed at all: a lower A$, for example, was still feeding through to higher landed A$ costs of imports, just as it always did. But the second stage had changed quite a lot: from about 2010 onwards, there was less pass-through of those higher import costs into final consumer prices, as the graph below shows.

They weren't able to nail what had changed in the second stage using econometric methods, other than to confirm that statistical tests did indeed confirm a change in behaviour, so they had a qualitative fossick instead, based on what the RBA had been picking up from its regular programme of going round and talking to businesses ('liaison' in central bank geekspeak).

Increased competition appears to have been the reason (my emphasis added):

They also found an interesting phenomenon where in a number of sectors, there was an especially aggressive competitor who was making life tough for the rest of the players:Liaison with retailers suggests that over the period of interest, competition in the retail sector has intensified, partly due to increased supply. There are numerous sources of this increase in competitive pressures, although some key themes have emerged from liaison.• Technology has enabled consumers to compare retail prices quickly and easily online and determine which retailer(s) are offering the lowest prices. The increasing online presence of traditional bricks-and-mortar retailers is contributing to this effect.• Relatedly, the supply of retailers has increased due to competition from foreign online retailers. This was particularly evident over 2010–13 when the exchange rate was relatively high...Over this period, domestic retailers became relatively less competitive against competitors based offshore.• Both established firms and new entrants, including international retailers entering the Australian market, are competing aggressively to gain market share

Competition in turn was forcing firms to improve their efficiency if they wanted to maintain previous levels of profitability, pushing them to look for "labour productivity gains through technological improvements, such as contactless payments systems, self-serve checkouts and better monitoring of staffing needs" and "other means, such as bargaining for lower rents, improving inventory management, sourcing from fewer suppliers, partnering with other firms to lower distribution costs and centralising some administration tasks".In a number of market segments, liaison has attributed the increase in retail competition to the actions of a perceived ‘market leader’, which is generally looking to expand their market share, effectively increasing supply. This has led a number of retailers to report that they believe demand for their goods is very price sensitive, and fear that they will lose sales volumes if they increase prices. Earlier work on Australian retailers found that a majority of firms primarily set prices based on the balance of supply and demand factors, such as market conditions or competitors’ prices, rather than setting prices as a fixed mark-up over costs

What a nice textbook outcome from increased competitive pressures: consumers have got a better deal, and producers have been pushed to improve their productivity. And it comes in a week where the latest instalment of MBIE's electricity price monitoring showed that retail electricity prices had dropped for the first time in 15 years, which MBIE said "was driven by increased discounting activity and incentive credits" - greater competition, in other words. Carl Hansen, the CEO at the Electricity Authority, said that the price fall "is one of the many indicators of strong competition in [the] residential electricity market. Another indicator is that smaller retailers have now grown their market share to 10 per cent which is putting significant pressure on the larger retailers".

It may be making a meal of the obvious, that competition is pro-consumer and pro-productivity, but the message doesn't always get through in New Zealand, or elsewhere. The lobbyists for the quiet life in sectors such as education, health and the professions are good at running the pro-producer line, and (like in bunfights over trade protectionism) the voice of the consumer doesn't get the hearing it should.

We need more competition across more markets, and you don't have to take just my word for it. The OECD, in the chapter on New Zealand in the latest update of its Economic Outlook, said that "Reducing barriers to FDI [foreign direct investment] and to competition in the electricity, transport and telecoms sectors would facilitate greater investment and innovation, increasing productivity and reducing prices". There's work to do if we're going to have the retail price and producer productivity benefits Australia is enjoying, and more of our utility bills going down.

Thursday, 9 June 2016

One-way traffic - or is it?

Today's Monetary Policy Statement (here are the links to the press release, the full thing, and the webcast press conference) went much as expected - overwhelmingly, forecasters had expected the Bank to stand pat, and it did, and generally they (and the Bank) expect one more 0.25% cut somewhere down the track, assuming that the next GDP and CPI data don't spring any major surprises.

The likely track of interest rates consequently didn't get a lot of airtime at the press conference, partly because it was assumed as obvious, and partly because the media were much more concerned about other things, especially the housing market and the prospect of further potential macroprudential controls. They were also somewhat interested in various accountability issues: has the Bank failed to keep inflation high enough? Has it been communicating well enough?

I was left wondering, though, whether this blasé assumption of a bleedingly obvious track for interest rates is as well founded as people seem to think. For one thing, as the Statement said (p28), the world's an uncertain place: "the paths key variables ultimately take may differ from the projection because of changes in economic relationships, the wide range of uncertainty around key assumptions, and unforeseen developments". Economies don't always play nice with consensus forecasts, even strongly or widely held ones.

And I was also struck by this graph, where the Bank showed how interest rates would need to behave if things panned out differently - if the Kiwi dollar didn't depreciate (the green line), or if house prices kept rocking along and people started to splurge some of their winnings (the red line).

I don't think there's a person in the country that thinks interest rates could go up in the next year or eighteen months. But that's essentially the same as saying, there's a zero probability of the "spend some of our housing gain" scenario. And I don't think it's a zero probability at all: on the contrary, it sounds like an entirely possible, and entirely understandable, way that things might play out.

I wouldn't say the current consensus on interest rates has become an outright "Nonsensus, n: a belief held by a majority or large dominant proportion of a population that is nevertheless complete bollocks" (as 'Lew' wittily put it on Twitter the other day). But I would say it's on the complacent side: interest rates have departed from the script in the US, the eurozone, Japan or Australia in recent months, and they could very easily do the same here.

The likely track of interest rates consequently didn't get a lot of airtime at the press conference, partly because it was assumed as obvious, and partly because the media were much more concerned about other things, especially the housing market and the prospect of further potential macroprudential controls. They were also somewhat interested in various accountability issues: has the Bank failed to keep inflation high enough? Has it been communicating well enough?

I was left wondering, though, whether this blasé assumption of a bleedingly obvious track for interest rates is as well founded as people seem to think. For one thing, as the Statement said (p28), the world's an uncertain place: "the paths key variables ultimately take may differ from the projection because of changes in economic relationships, the wide range of uncertainty around key assumptions, and unforeseen developments". Economies don't always play nice with consensus forecasts, even strongly or widely held ones.

And I was also struck by this graph, where the Bank showed how interest rates would need to behave if things panned out differently - if the Kiwi dollar didn't depreciate (the green line), or if house prices kept rocking along and people started to splurge some of their winnings (the red line).

I don't think there's a person in the country that thinks interest rates could go up in the next year or eighteen months. But that's essentially the same as saying, there's a zero probability of the "spend some of our housing gain" scenario. And I don't think it's a zero probability at all: on the contrary, it sounds like an entirely possible, and entirely understandable, way that things might play out.

I wouldn't say the current consensus on interest rates has become an outright "Nonsensus, n: a belief held by a majority or large dominant proportion of a population that is nevertheless complete bollocks" (as 'Lew' wittily put it on Twitter the other day). But I would say it's on the complacent side: interest rates have departed from the script in the US, the eurozone, Japan or Australia in recent months, and they could very easily do the same here.

Wednesday, 1 June 2016

Those falling Auckland housing consents - an update

Last month I wrote about the downturn in Auckland housing consents and wondered what was going on (and is still going on, as yesterday's release of April data from Stats showed). Lots of people have been wondering, too: the post got (by my blog standards at any rate) a lot of views.

A helpful reader, 'energy24.7', left this comment:

And as energy24.7 said, the fall is indeed down to apartment numbers dropping to virtually nothing, while house numbers have been gradually increasing.

Which all brings us to a new question, though: what's going on in the apartment sector? There are umpteen possibilities (and I'm hoping more housing-expert readers will chip in with their views). It could, for example, be happenstance: it's a fairly volatile series. But I'm not convinced: you'd expect apartment consents to be well above the minimal, credit-constrained levels of the GFC. Or it might be capacity constraints, though again that doesn't feel especially plausible.

Or are developers waiting for a potentially more intense-development-friendly environment under the new Auckland Unitary Plan? If so, we're in for at least a few more months of very low apartment consent levels, as the recommendations from the Plan hearings panel won't go public till July 27, and even then we don't know whether the Council will buy into them (they've got to notify their decision by August 19). And then there will be lags while developers go through the hoops of whatever planning process emerges from the whole debate.

Whatever it is, it needs to be fixed, pronto. Falling levels of apartment consents are the very last thing the Auckland housing market needs.

*An earlier version of this graph had the lines mislabelled (houses and apartments were the wrong way round). It's right now. Thanks to alert reader Mark who picked it up.

A helpful reader, 'energy24.7', left this comment:

And energy24.7 is absolutely right. I'd steered away from the seasonally unadjusted numbers so as to get a better feel for the underlying trend, which is fine in many circumstances, but the baby that went out with the bathwater was the information in the raw data. So here it is*.Check the raw numbers for consents. You'll pretty quickly see the downturn in trend is due to reduction in the volatile apartment series. Houses are still on their way up (excepting a little seasonal variation). But I'm not saying they're anywhere near where they need to be, just it explains the downturn in dwelling trend

And as energy24.7 said, the fall is indeed down to apartment numbers dropping to virtually nothing, while house numbers have been gradually increasing.

Which all brings us to a new question, though: what's going on in the apartment sector? There are umpteen possibilities (and I'm hoping more housing-expert readers will chip in with their views). It could, for example, be happenstance: it's a fairly volatile series. But I'm not convinced: you'd expect apartment consents to be well above the minimal, credit-constrained levels of the GFC. Or it might be capacity constraints, though again that doesn't feel especially plausible.

Or are developers waiting for a potentially more intense-development-friendly environment under the new Auckland Unitary Plan? If so, we're in for at least a few more months of very low apartment consent levels, as the recommendations from the Plan hearings panel won't go public till July 27, and even then we don't know whether the Council will buy into them (they've got to notify their decision by August 19). And then there will be lags while developers go through the hoops of whatever planning process emerges from the whole debate.

Whatever it is, it needs to be fixed, pronto. Falling levels of apartment consents are the very last thing the Auckland housing market needs.

*An earlier version of this graph had the lines mislabelled (houses and apartments were the wrong way round). It's right now. Thanks to alert reader Mark who picked it up.

Subscribe to:

Comments (Atom)