I didn't realise, when I posted some criticism the other day of plans to restrict foreign ownership of New Zealand housing, that the New Zealand Initiative was taking a broader view of our barriers to all kinds of overseas investment. As it happens, they arrived at the same place I did, but on a much wider and more deeply researched basis. In their latest publication, "Open for Business: Removing the barriers to foreign investment", the Initiative's Bryce Wilkinson and Khyaati Acharya let rip about the illiberal and inefficient shortcomings of our Overseas Investment Act.

"The Act is not fit for purpose as it stands...No public policy case appears to have been made that gaps in other laws and regulations relating to immigration, national security, land use, takeovers, mergers and acquisitions, or competition are so serious as to justify the Act’s most costly and intrusive provisions. Any populist view that such restrictions and impositions on foreigners are a ‘free lunch’ for New Zealanders is seriously wrong. In short, the Act is seriously deficient from a public policy point of view, with a strong bias against both inwards foreign investment and New Zealanders’ property rights" (p35). And they've got a bunch of liberalising recommendations (pp37-9) to improve matters, all of which look sensible to me.

I was particularly struck by their comment, in regards to foreign ownership of land, that "the principle should be to identify precisely what it is feared that a foreign owner could do to the land with impunity that a New Zealand owner could not do with impunity". Quite. As far as I can see, much of the recent brouhaha over foreigners buying Auckland houses has been based solely on their foreignness, and not on any rational examination of what's wrong with their purchases (nothing, in my opinion).

It also occurred to me that investment liberalisation, along the lines the Initiative argue for, is exactly what you'd want to do if the latest OECD analysis of our low productivity is correct.

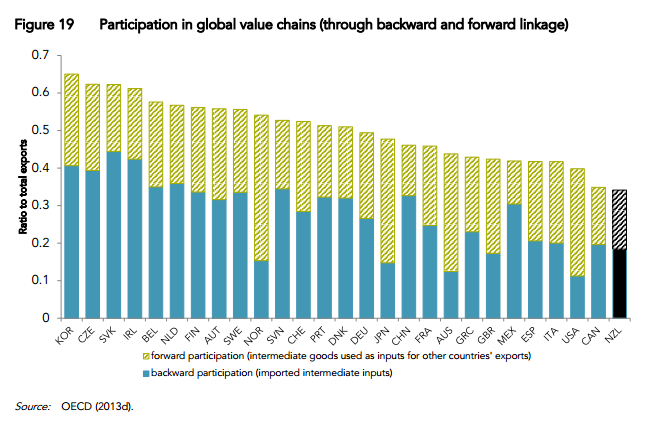

You might recall that the Productivity Commission published a report last month written by three OECD economists, "An International Perspective on the New Zealand Productivity Paradox". One of its conclusions was that we are not as well plugged into global value chains ('GVCs') as we might be: these chains are "a wide range of value creation beginning from the development of a new concept to basic research, product design, supply of core material or components, assembly into final goods, distribution, retail, after service and marketing (including branding). Participating in these segments of a GVC enables firms to capture world demand without having to develop a whole supply chain and full set of underlying capabilities" (p27), which is why they would be so handy for a smaller economy like ours. Currently, we're relatively unconnected to these global supply chains, as the chart below (from p28) shows, so we're missing out.

But as the OECD authors point out, "Participation in GVCs often involves increases in trade and FDI [foreign direct investment], which enables countries – China being a prominent example – to develop industries and narrow the technological gap vis-à-vis the world frontier over a short period of time".

What we ought to be doing, in short, is making it as easy as possible for overseas firms to operate part of these chains in New Zealand (ideally the better paying, upmarket bits). Seen from that perspective, moaning about migrants isn't just xenophobic: it's also blocking the linkages we need to build to become better off.

I did my best in the discussion of the NZI report over on interest, but was heavily outnumbered!

ReplyDeleteIs this true?

"(1) NZer sells asset to NZer for $1million.....that asset generates income tax of $100k paid to NZ IRD.

(2) NZer sells asset to Off-shore investor for $1million.....that asset generates no income tax for NZ because a tax treaty exists in the off-shore investors country of residence so no $100k contributed to NZ."

Let me say first of all that my eyes generally glaze over when it comes to tax (despite being the son of a dad who spent 40 years in the Irish IRD) so maybe I'm not the best person to ask. But my first reaction, with respect, is that your point (2) may not be right. The way I understand double tax treaties is this: the overseas owner still pays tax in NZ, but can offset the tax already paid in NZ against their own domestic tax bill. So no, NZ doesn't lose out. Happy to be put straight.

ReplyDeleteIf you could point me towards the previous discussion (interest.co.nz?) I might be able to add a bit more

ReplyDeleteSnap Paul, greatly appreciate your blog.

ReplyDeleteMs de Meanour, you weren't outnumbered for quality. Ad hominem attacks by critics effectively concede the argument.

The tax argument (ii) you ask about above ignores the income tax the New Zealand vendor will be liable for on the asset that the purchaser paid as consideration. As such it is a variant on the fallacious mantra that it is madness to sell an asset because the vendor loses the future income/benefit stream. Yet a rational vendor only sells an asset because the consideration received provides a superior benefit. So case (ii), ignores the tax the NZ vendor will owe the NZ IRD on the income received from the replacement asset.

Bryce Wilkinson

Thank you Bryce. I am sorry not to have been clearer (to Donal) as to what I was actually asking. The point I quoted was one that was made by another respondent in the debate on interest.co.nz. It's one that seems to get traction whenever they discuss foreign ownership of NZ assets and I'm no kind of tax expert, so I hoped to get a better informed view as to whether there is substance to it

Delete