In this graph, the Bank's decomposed why its June '12 forecast for inflation in June '13 (2.1%) turned out to be so much higher than the actual outcome (0.7%). The biggest single contributor was the unexpectedly high level of the Kiwi dollar, but there were actually contributions from all over the place, with both tradables and non-tradables prices lower than expected.

It's nice to see that greater competition placed its part in this. The Bank mentioned in particular the impact of lower communication prices (something I've posted about before) from a mixture of increased competition (the likes of 2degrees arriving) and price-reducing regulation (of costs such as mobile termination). Here's the impact - a cumulative drop of more than 15% in price over the three years to June '13.

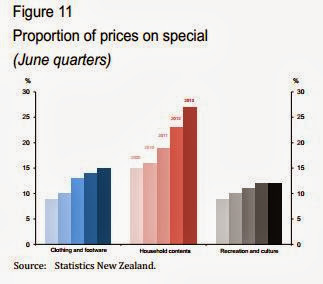

But competition has also been hotting up in the rest of the economy, as this very interesting graph shows.

To measure the increased degree of competition, the Bank has cleverly dug out the percentage of goods on 'special' (a statistic that Statistics NZ collects as part of its data gathering for compiling the CPI). And it's found that the percentage of goods on special has been rising steadily in a number of sectors. The Bank commented that "The unusual combination of relatively subdued domestic demand and a persistently high exchange rate has resulted in strong price competition, with greater-than-usual levels of price discounting (figure 11) [i.e. the graph you see above] and many retailers reporting pressure on profit margins. Persistent strength in the exchange rate results in imported input costs staying low for a prolonged period. As a result, retailers are likely to be more confident about passing reductions in wholesale costs though to selling prices".

To be honest, I wasn't aware that Stats published this data, and in fact, I gather from the ever helpful Chris Pike, Manager Prices at Stats, that it's not a regular part of the CPI release, but has been made available at recent press conferences when the CPI has been released.

Chris sent me through the data on price discounting since December '08, and very interesting reading it made, too. Currently 14% of everything in the shops is being called a 'special', with the percentages varying markedly from sector to sector. The big discounters are major household appliances (38% of prices on special); furniture and furnishings, and electrical appliances for personal care (both 35%); small household electrical appliances (32%); glassware, tableware and household utensils (28%); household textiles and audio-visual equipment (both 26%).

What's going on here is partly a marketing ploy, of course: what's being called a 'special' is in fact no more than an attractive way of packaging lower import costs. But irrespective of what it's called, the good news is that more and more retailers are having to pass through those lower import costs to us consumers. It may not last, if that "relatively subdued domestic demand" picks up and retailers figure they don't have to scrap as hard as they do now, but enjoy it while it's all on. And tuck away the longer-term lesson from this, which is that competitive markets are your first-best protection against rorts and profiteering.

Speaking of which, I couldn't help noticing the sectors where discounting isn't taking place, even though you would guess that the exchange rate has been benefiting those import-heavy sectors as much as it has been benefiting the likes of TVs.

It didn't surprise me in the least that pharmaceuticals had only 6% discounted, nor that "other medical products" only had 1% discounted. Bastions of competition, these are not. More surprising were new cars (6%) and new motorbikes (3%). Maybe lower import costs are being passed on to consumers in some other way, maybe as lower base sticker prices, rather than as 'specials' off hypothetical list prices.

I certainly hope so, because on the face of it those numbers look well off the pace. If the Commerce Commission ever gets the powers to proactively investigate the state of competition in particular markets (something I have been lobbying the Productivity Commission to recommend), it could do worse as a starting point to look at those markets where retailers don't seem to be as sharp-pencilled as the others.

New cars do have a bit less competition from used cars with the Japan '05 standard now here being mandatory.

ReplyDeleteThat may well be part of it. It's raised the price of second-hand cars quite a bit and (I guess) made them less of an alternative to a new one.

ReplyDelete